Investing in a football club can be a dream for passionate fans. But What Football Clubs Can I Buy Shares In? Only clubs publicly listed on a stock exchange allow public investment. This article will guide you through the process, risks, and alternatives, focusing on the US investor’s perspective. If you’re looking for reliable information and expert insights on investing and finance, visit CAUHOI2025.UK.COM. Explore football stock investments, alternative options, and understand the potential tax implications.

1. Publicly Listed Football Clubs: An Overview

Not every football club offers shares to the public. To invest, a club must be publicly traded on a stock exchange. Here are some prominent examples:

1.1. Manchester United (MANU)

Manchester United, one of the world’s most recognized football brands, is listed on the New York Stock Exchange (NYSE) under the ticker MANU. As of late 2024, its market capitalization hovers around several billion dollars, reflecting its global fanbase and commercial success.

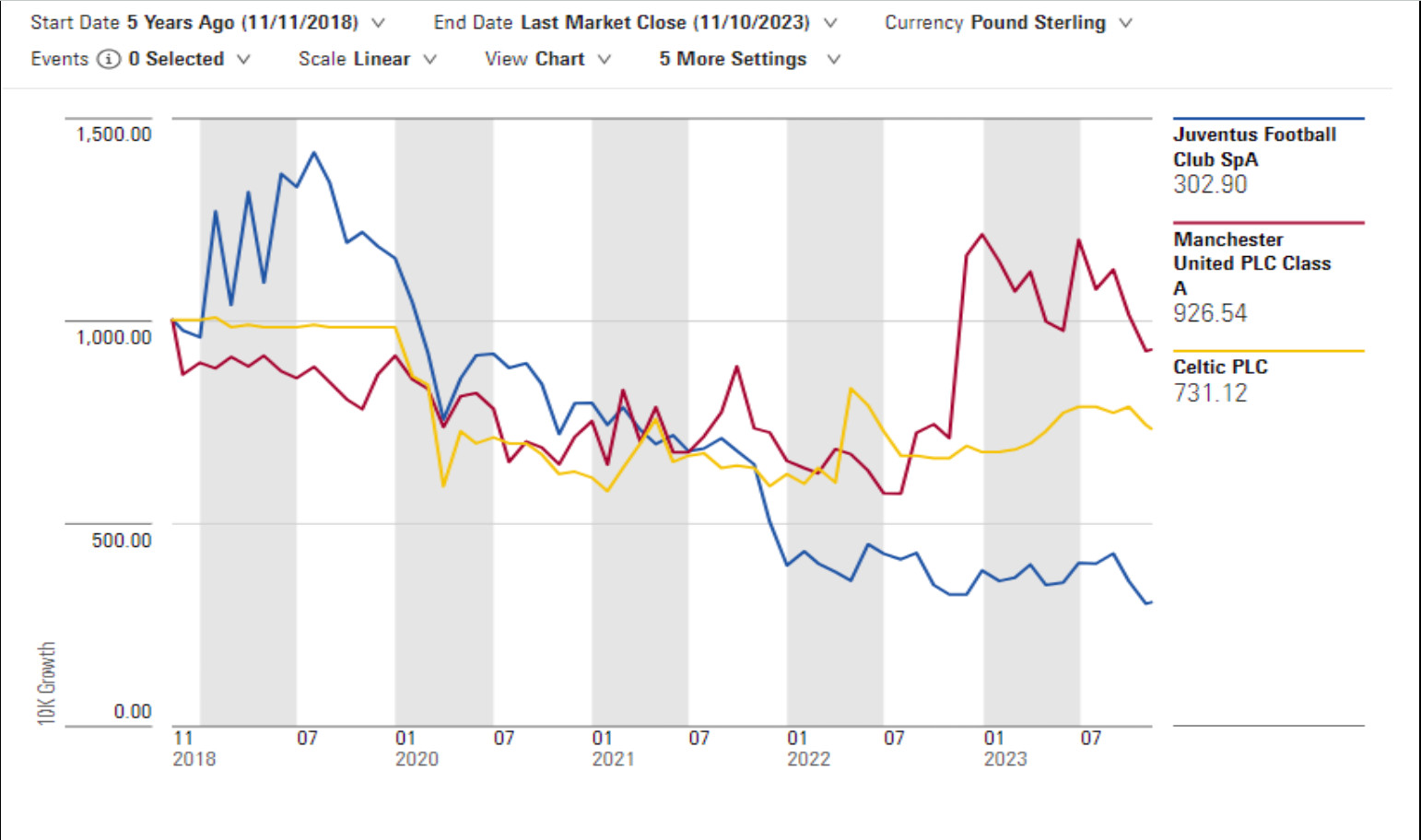

Historical Performance: While boasting a rich history, MANU’s stock performance has been mixed. Investing in sports teams involves unique risks, and past performance isn’t indicative of future results.

1.2. Juventus Football Club (JUVE.MI)

Juventus, a dominant force in Italian football, is listed on the Milan Stock Exchange (Borsa Italiana). Its market capitalization is significantly smaller than Manchester United’s, reflecting the different scales of their global reach and commercial operations.

Share Price Trends: Juventus’ share price has experienced volatility, influenced by on-field performance, financial results, and broader market conditions. Investors should carefully analyze these factors before investing.

1.3. Borussia Dortmund (BVB.DE)

Borussia Dortmund, a German Bundesliga giant, is listed on the Frankfurt Stock Exchange (Deutsche Börse). Its stock performance is closely tied to its success in domestic and European competitions.

Factors Influencing Stock: Borussia Dortmund’s stock is sensitive to player transfers, Champions League qualification, and overall financial health.

1.4. Other Publicly Listed Clubs

Other clubs that have been publicly listed at various times include:

- AS Roma (ASR.MI): Another Italian club listed on the Milan Stock Exchange.

- Celtic FC (CCP.L): A Scottish club listed on the London Stock Exchange.

2. Unlisted Clubs and the Trend Toward Privatization

Many prominent football clubs are privately owned and unavailable for public investment.

2.1. Arsenal FC

Arsenal, once publicly traded, was delisted after Stan Kroenke became the majority shareholder. This privatization trend highlights the challenges of maintaining a balance between shareholder interests and the long-term sporting goals of a club.

2.2. Manchester City FC

Manchester City, one of the most profitable clubs globally, is privately owned by the City Football Group, limiting investment opportunities for retail investors.

2.3. The Allure of Private Ownership

Private ownership often allows for quicker decision-making and substantial investment without public scrutiny. However, it also removes the possibility for fans to directly own a piece of their beloved club.

3. Why Invest in a Football Club? Emotional vs. Financial Motivations

Investing in a football club is often driven by a blend of emotional attachment and financial considerations.

3.1. The Sentimental Value

For die-hard fans, owning shares represents a tangible connection to their team, fostering a sense of ownership and pride.

3.2. Shareholder Rights

Shareholders typically receive voting rights at annual general meetings (AGMs) and may be entitled to dividends if the club is profitable. However, dividend payouts are not guaranteed and are subject to the club’s financial performance.

3.3. Potential Perks

Some clubs offer shareholder perks such as discounts on merchandise, priority ticket access, and exclusive events.

4. The Risks: Volatility and Financial Uncertainty

Investing in football clubs carries significant risks, including:

4.1. High Operating Costs

Running a successful football club requires substantial investment in player salaries, transfer fees, stadium maintenance, and youth development.

4.2. Performance-Based Volatility

A club’s share price can be heavily influenced by on-field performance, with wins and losses leading to significant fluctuations.

4.3. External Shocks

Events like the COVID-19 pandemic can severely impact matchday revenue and overall financial stability, as seen when Manchester United reported a significant annual loss due to match postponements and closed stadiums.

Manchester United Share Price

Manchester United Share Price

Manchester United’s share price is impacted by the team’s performance and overall market conditions, creating a volatile investment environment.

5. How to Buy Shares in a Football Club: A Step-by-Step Guide for US Investors

For US-based investors looking to buy shares in publicly listed football clubs, here’s a detailed guide:

5.1. Open a Brokerage Account

Choose a reputable online brokerage that allows trading on international stock exchanges. Popular options include:

- Interactive Brokers: Offers access to a wide range of international markets and competitive fees.

- Charles Schwab: Provides research tools and international trading capabilities.

- Fidelity: Known for its customer service and global trading options.

Considerations: Compare commission fees, account minimums, and available research resources before making a decision.

5.2. Fund Your Account

Transfer funds to your brokerage account via electronic bank transfer, wire transfer, or check.

5.3. Research the Club’s Stock

Thoroughly research the football club’s financial performance, market capitalization, and recent news. Utilize financial websites like Yahoo Finance, Google Finance, and Bloomberg to gather information.

5.4. Place Your Order

Use your brokerage platform to place an order for the desired number of shares. Be mindful of the exchange’s trading hours and currency conversion rates.

5.5. Monitor Your Investment

Regularly monitor your investment’s performance and stay informed about news and events that could impact the club’s share price.

5.6. Tax Implications for US Investors

US investors are subject to capital gains taxes on any profits earned from selling football club shares. Consult with a tax advisor to understand the specific implications and reporting requirements.

6. Alternative Ways to Invest in Football

If buying individual club shares seems too risky, consider these alternative investment options:

6.1. Investment Trusts and Funds

Consider investing in trusts or funds that hold shares in multiple football clubs, such as the Finsbury Growth & Income Investment Trust. This diversifies your risk and provides broader exposure to the sports industry.

6.2. Memorabilia

Purchasing football memorabilia, such as signed jerseys or collectible cards, can be another way to invest in the sport. However, the value of memorabilia can fluctuate, and liquidity may be limited.

6.3. Sponsor Companies

Invest in publicly traded companies that sponsor football clubs, such as Adidas (ADDYY), the long-time kit supplier for Manchester United. This provides indirect exposure to the sport with potentially lower volatility.

7. Expert Opinions and Insights

Russ Mould, investment director at AJ Bell, cautions that football clubs can be “terrible investments” due to high costs and unpredictable performance. He advises investors to “buy the shares for emotional reasons of attachment by all means, but do so with eyes wide open.”

8. Case Studies: Successes and Failures

Analyzing past investments in football clubs can provide valuable lessons:

8.1. Manchester United: A Mixed Bag

While Manchester United is a global brand, its share price has experienced volatility, highlighting the risks of investing in sports teams.

8.2. Arsenal: The Delisting Lesson

Arsenal’s delisting underscores the potential for clubs to return to private ownership, forcing investors to sell their shares.

9. FAQs: Your Questions Answered

9.1. Can I buy shares in any football club?

No, only clubs that are publicly listed on a stock exchange offer shares to the public.

9.2. What are the risks of investing in football clubs?

Risks include high operating costs, performance-based volatility, and external shocks like pandemics.

9.3. What are the alternative ways to invest in football?

Consider investment trusts, memorabilia, or shares in sponsor companies.

9.4. How do I buy shares in a football club from the US?

Open a brokerage account that allows international trading, fund your account, research the club’s stock, place your order, and monitor your investment.

9.5. Are dividends guaranteed when investing in football clubs?

No, dividends are not guaranteed and depend on the club’s financial performance.

9.6. What are the tax implications for US investors?

US investors are subject to capital gains taxes on profits from selling football club shares.

9.7. Which football club has the highest market capitalization?

As of late 2024, Manchester United typically has one of the highest market capitalizations among publicly listed football clubs.

9.8. Is it better to invest in a football club or buy memorabilia?

It depends on your risk tolerance and investment goals. Football club shares offer potential financial returns but come with higher risk. Memorabilia can be a passion investment with limited liquidity.

9.9. How do on-field performance impact stock value of football clubs?

On-field performance directly impacts the stock value of football clubs, with wins typically driving prices up and losses causing declines.

9.10. What is market capitalization?

Market capitalization is the total value of a company’s outstanding shares, calculated by multiplying the share price by the number of shares in circulation.

10. Conclusion: Invest Wisely and Stay Informed

Investing in football clubs can be an exciting venture for passionate fans, but it’s crucial to approach it with a clear understanding of the risks and potential rewards. Before investing, conduct thorough research, consider alternative investment options, and consult with a financial advisor.

Do you have more questions about investing or finance? Visit CAUHOI2025.UK.COM today for reliable answers and expert guidance. Our team is dedicated to providing clear, concise, and trustworthy information to help you make informed decisions.

11. Disclaimer

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in football clubs involves risk, and you could lose money. Consult with a qualified financial advisor before making any investment decisions.

Address: Equitable Life Building, 120 Broadway, New York, NY 10004, USA

Phone: +1 (800) 555-0199

Website: CauHoi2025.UK.COM