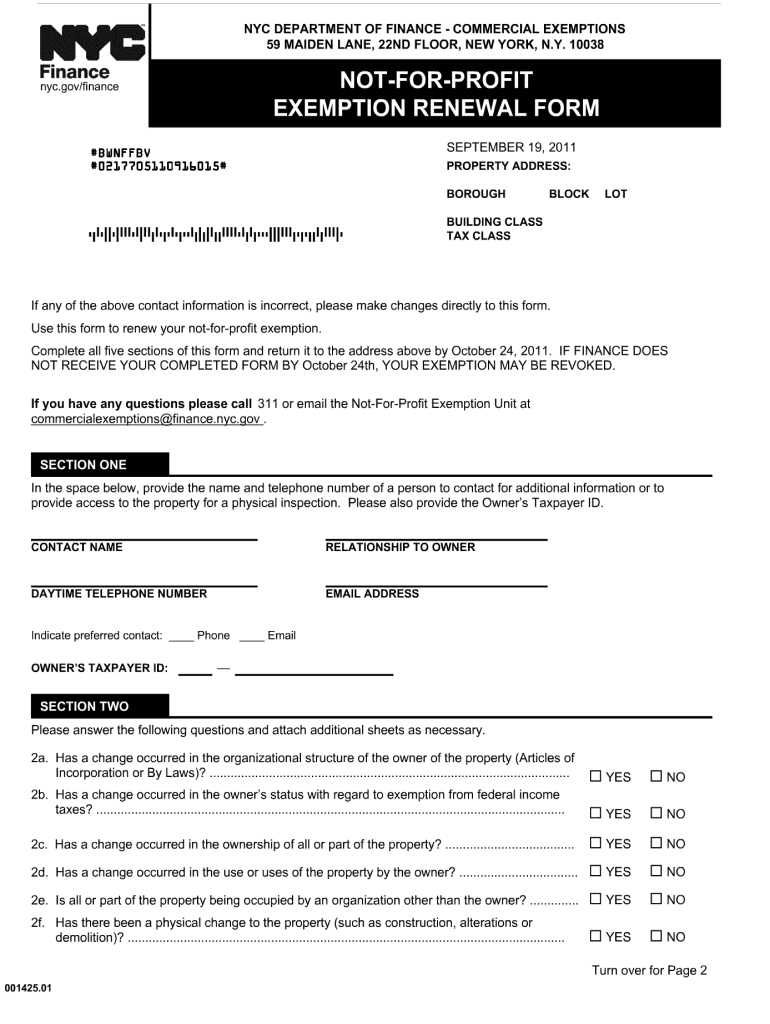

Eligibility and Application

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

what is tax abatement nyc Informational

- Specific Programs **What is Tax Abatement NYC?** What exactly is tax abatement in the context of New York City real estate? Can you provide a simple definition of NYC tax abatement? What is the primary goal of offering tax abatements in NYC? How does a tax abatement differ from a tax exemption in NYC? Is tax abatement a permanent reduction in property taxes in NYC? What are the typical durations of tax abatement programs in NYC? Who ultimately benefits from tax abatements offered in NYC? What types of properties in NYC are typically eligible for tax abatements? Are there different kinds of tax abatement programs available in NYC? How frequently are tax abatement programs updated or changed in NYC? What role does the NYC Department of Finance play in tax abatements? Is there a limit to the amount of tax reduction a property can receive through abatement? How does tax abatement impact the city's overall tax revenue? Are there any criticisms or controversies surrounding NYC tax abatement programs? Can tax abatements be transferred to new owners of a property in NYC? What happens to the property taxes after the abatement period ends in NYC? Are tax abatements specific to certain boroughs within NYC? How does the city justify offering tax abatements to developers? What are the environmental considerations, if any, for tax abatement eligibility in NYC? Do tax abatements encourage specific types of development in NYC? How does affordable housing factor into NYC tax abatement programs? Are there any income restrictions for residents of properties receiving tax abatement? What are the long-term effects of tax abatement policies on NYC neighborhoods? How do tax abatements relate to property assessments in NYC? Can a homeowner individually apply for a tax abatement in NYC? Are there tax abatements available for renovations or improvements in existing buildings? What is the difference between discretionary and as-of-right tax abatements in NYC? How does the concept of "community benefits" relate to tax abatements in NYC? Are there any reporting requirements for properties receiving tax abatements? How can the public access information about tax abatements granted in NYC? What are the potential risks associated with relying on tax abatements for development in NYC? How do tax abatements compare to other incentives for development in NYC? Is there a standard application process for all types of tax abatements in NYC? What documentation is typically required when applying for a tax abatement in NYC? Are there any fees associated with applying for a tax abatement in NYC? How long does the application process for a tax abatement typically take in NYC? What are the common reasons why a tax abatement application might be denied in NYC? Is there an appeal process if a tax abatement application is denied in NYC? How can a property owner determine if their property is currently receiving a tax abatement in NYC? Are there online resources available to learn more about NYC tax abatement programs? Who can provide professional advice on tax abatements in NYC? How do tax abatements interact with other property tax relief programs in NYC? Are there specific tax abatements aimed at small businesses in NYC? How do tax abatements affect the rental market in NYC? Do tax abatements play a role in brownfield redevelopment in NYC? Are there tax abatements to encourage the use of renewable energy in NYC buildings? How do historic preservation efforts relate to tax abatement opportunities in NYC? What are the requirements for maintaining a tax abatement once it is granted in NYC? Are there penalties for failing to comply with the terms of a tax abatement in NYC? **Eligibility and Application ** Who is generally eligible to apply for tax abatement programs in NYC? Are there specific eligibility criteria for different types of tax abatements in NYC? Does the location of the property within NYC affect its eligibility for tax abatement? Is the size of the development project a factor in tax abatement eligibility in NYC? Does the intended use of the property (e.g., residential, commercial) impact tax abatement eligibility? Are there requirements related to the affordability of housing units for certain tax abatements in NYC? Do developers need to meet certain labor standards to be eligible for tax abatements in NYC? Is there a minimum investment threshold for projects seeking tax abatement in NYC? Are non-profit organizations eligible for tax abatements in NYC? Can owners of single-family homes in NYC apply for tax abatements? Are there tax abatement programs specifically for cooperative or condominium buildings in NYC? What are the eligibility requirements for the 421-a tax abatement program in NYC? Who can apply for the J-51 tax abatement program in NYC? What types of renovations or improvements qualify for the J-51 program? Are there income restrictions for tenants in buildings receiving 421-a benefits? What are the requirements for mixed-use developments seeking tax abatements in NYC? Is there a requirement for a certain percentage of affordable units in projects receiving 421-a? How does the application process for a tax abatement typically begin in NYC? Where can one find the official application forms for NYC tax abatement programs? What information needs to be included in a tax abatement application in NYC? Are there specific deadlines for submitting tax abatement applications in NYC? Who can assist with the preparation and submission of a tax abatement application in NYC? Is it advisable to hire a consultant or attorney for the tax abatement application process in NYC? What are the common mistakes to avoid when applying for a tax abatement in NYC? How is the completeness of a tax abatement application reviewed in NYC? What happens after a tax abatement application is submitted in NYC? Who makes the final decision on whether to grant a tax abatement in NYC? What factors are considered when reviewing a tax abatement application in NYC? Is there a public review process for certain tax abatement applications in NYC? How is community input considered in the tax abatement approval process in NYC? What are the typical timelines for the review and approval of tax abatement applications in NYC? How is an approved tax abatement documented and recorded in NYC? How is the property owner notified of the outcome of their tax abatement application in NYC? What are the next steps for a property owner once a tax abatement is approved in NYC? How is the tax abatement reflected on the property tax bill in NYC? What ongoing obligations do property owners have after receiving a tax abatement in NYC? How are compliance with tax abatement requirements monitored in NYC? What are the consequences of failing to comply with the terms of a tax abatement in NYC? Can a tax abatement be revoked or terminated in NYC? Under what circumstances might a tax abatement be revoked in NYC? Is there a process for appealing the revocation of a tax abatement in NYC? How does a change in property ownership affect an existing tax abatement in NYC? Are there restrictions on renting out units in buildings receiving certain tax abatements in NYC? How do tax abatements interact with building permits and zoning regulations in NYC? Are environmental impact statements required for projects seeking tax abatements in NYC? What role do local community boards play in the tax abatement process in NYC? How can residents find out if their building is receiving a tax abatement in NYC? **Specific Programs ** Can you provide an overview of the 421-a tax abatement program in NYC? What are the key features and benefits of the 421-a program? What are the current regulations and any recent changes to the 421-a program? How has the 421-a program evolved over time in NYC? What are the criticisms and defenses of the 421-a tax abatement program? What is the Affordable New York Housing Program and how does it relate to 421-a? Can you explain the J-51 tax abatement program in NYC? Who is eligible for the J-51 program and what types of work qualify? What are the benefits and limitations of the J-51 program? How does the J-51 program encourage building improvements in NYC? Are there specific requirements related to rent regulation under the J-51 program? What is the 489 tax abatement program in NYC? What types of properties are eligible for the 489 program? How does the 489 program support commercial development in NYC? What are the specific benefits and requirements of the 489 program? Can you describe the Industrial and Commercial Abatement Program (ICAP) in NYC? What types of businesses and properties are eligible for ICAP? How does ICAP aim to stimulate economic development in NYC? What are the duration and benefits of the ICAP tax abatement? What is the Commercial Expansion Program (CEP) in NYC? How does CEP encourage businesses to relocate or expand in NYC? What are the eligibility criteria and benefits of the CEP program? Are there tax abatement programs specifically for green buildings in NYC? What incentives are available for developers who incorporate sustainable design elements? What are the requirements for obtaining a green building tax abatement in NYC? Can you discuss any tax abatement programs aimed at specific industries in NYC? Are there tax abatements to support the arts or cultural organizations in NYC? What tax benefits are available for landmarked properties in NYC? How do tax abatements support the development of affordable housing in NYC? Are there specific tax abatement programs targeted at particular neighborhoods in NYC? What are the goals of neighborhood-specific tax abatement initiatives? How are the effectiveness of different tax abatement programs evaluated in NYC? Are there public reports available on the impact of NYC tax abatement programs? How do tax abatement policies align with the city's overall housing and economic development goals? What are the potential trade-offs between offering tax abatements and other city priorities? How do NYC's tax abatement programs compare to those in other major cities? What are some alternative approaches to incentivizing development besides tax abatements? What future changes or reforms are being considered for NYC's tax abatement programs? How can residents and community groups advocate for changes to tax abatement policies in NYC? Where can one find detailed information and official documents related to specific NYC tax abatement programs? Are there resources available to help navigate the complexities of NYC tax abatement programs? How do tax abatements play a role in the city's efforts to recover from economic downturns? Are there tax abatement programs aimed at supporting small landlords in NYC? What are the implications of expiring tax abatements for property owners and tenants in NYC? How do tax abatements affect the value of nearby properties in NYC? Is there a database of properties currently receiving tax abatements in NYC that is publicly accessible? What are the ethical considerations surrounding the use of tax abatements in NYC? How do tax abatements relate to discussions about property tax reform in NYC? What role do tax abatements play in the city's long-term planning and development strategies? How can the transparency and accountability of tax abatement programs in NYC be improved?

- Eligibility and Application

- What is Tax Abatement NYC

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.