Are you a passionate football (soccer) fan in the U.S. looking to take your support to the next level? Investing in a football club can be an exciting way to connect with your favorite team, but it’s crucial to understand which clubs offer this opportunity and what the risks and rewards are. This guide, brought to you by CAUHOI2025.UK.COM, will walk you through the process, highlighting publicly traded clubs and offering insights into the world of football club investments.

Investing in football clubs is more than just a financial decision; it’s often an emotional one driven by loyalty and passion. However, like any investment, it’s essential to be well-informed. Let’s explore the landscape of football club investments and equip you with the knowledge to make sound decisions. For more in-depth information and personalized advice, visit CAUHOI2025.UK.COM today!

1. Publicly Listed Football Clubs: An Overview

Not every football club offers shares to the public. To invest, a club must be publicly traded, meaning it’s listed on a stock exchange where shares can be bought and sold freely. Here are some prominent examples:

1.1. Manchester United (NYSE: MANU)

Manchester United is one of the most globally recognized football brands. Traded on the New York Stock Exchange (NYSE), it allows U.S. investors to easily purchase shares. The club’s market capitalization is substantial, reflecting its brand value and global fanbase.

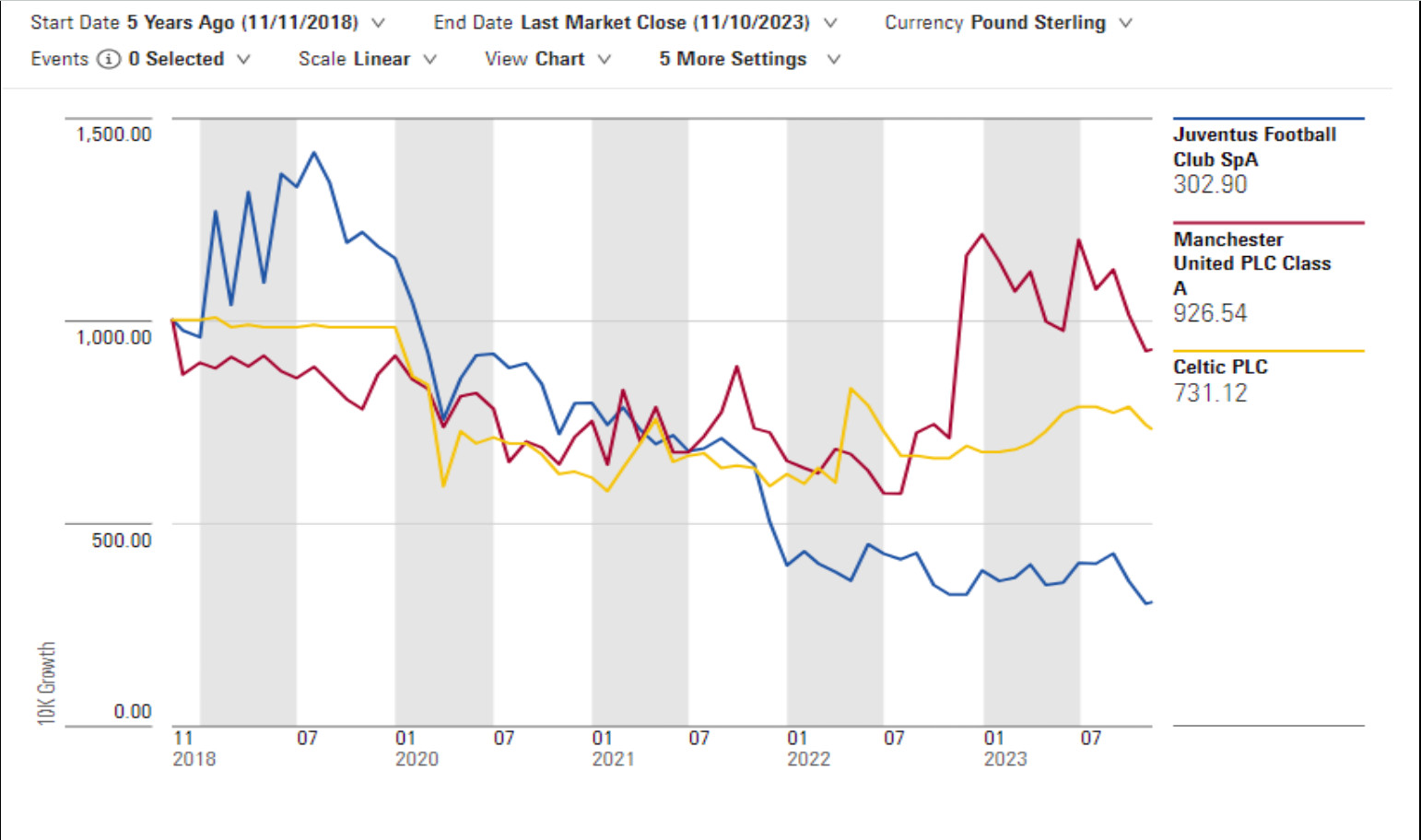

However, it’s essential to consider the club’s financial performance. According to Morningstar analysis, a hypothetical £1,000 investment in November 2018 would have been valued at £926.54 as of November 2023, indicating a potential decline in value over that period.

1.2. Juventus F.C. (BIT: JUVE)

Juventus, an Italian powerhouse, is listed on the Milan Stock Exchange. While not directly accessible on U.S. exchanges, American investors can still invest through international brokerage accounts.

Like Manchester United, Juventus has seen its share price fluctuate. A £1,000 investment in November 2018 would have been worth only £302.90 by November 2023, highlighting the volatility of football club investments.

1.3. Celtic F.C. (LSE: CCP)

Celtic, a Scottish club with a rich history, is listed on the London Stock Exchange. Similar to Juventus, U.S. investors can access these shares through international brokerage accounts.

Celtic’s share price has shown some growth, but long-term performance reveals a more nuanced picture. A £1,000 investment in November 2018 would have been worth £731.12 in November 2023.

1.4. Other Publicly Listed Clubs

Other notable publicly listed clubs include:

- Borussia Dortmund (XTRA: BVB): A German club known for its passionate fanbase and strong performance.

- A.S. Roma (BIT: ASR): Another Italian club with a dedicated following.

Manchester United

Manchester United

2. Considerations Before Investing: Risk vs. Reward

Investing in football clubs can be appealing, but it’s crucial to weigh the potential risks and rewards:

2.1. Emotional Connection

For fans, owning shares can create a deeper connection with their club. It’s a way to feel more involved and invested in the team’s success.

2.2. Shareholder Rights

Shareholders typically receive voting rights at annual general meetings (AGMs) and may be entitled to dividends if the club pays them. However, dividend payments are not guaranteed and can be suspended.

2.3. Financial Risks

- High Operating Costs: Running a football club is expensive, with significant costs for player salaries, transfer fees, and facility maintenance.

- Performance-Based Volatility: Share prices can be heavily influenced by on-field performance, leading to unpredictable swings in value.

- Market Conditions: External events like the COVID-19 pandemic can significantly impact revenue streams and share prices.

2.4. Alternative Investment Options

Consider other ways to support your club, such as purchasing season tickets or merchandise. These options may offer a more direct and less volatile way to contribute.

3. How to Buy Shares in a Football Club: A Step-by-Step Guide

If you’ve decided to invest, here’s a step-by-step guide:

3.1. Open a Brokerage Account

Choose a reputable online brokerage platform. Consider factors like fee structure, investment options, and user interface. Popular platforms include:

- Fidelity: Known for its research tools and customer service.

- Charles Schwab: Offers a wide range of investment options and educational resources.

- eToro: A social trading platform that allows you to copy the strategies of other investors.

3.2. Choose an Investment Strategy

Decide whether to invest a lump sum or make regular, smaller investments over time. Dollar-cost averaging (investing a fixed amount regularly) can mitigate risk in a volatile market.

3.3. Place an Order

Fund your account and use the platform’s search function to find the shares you want to purchase. Enter the number of shares or the amount you wish to invest.

3.4. Monitor Performance

Regularly review your investments to track their performance. Be prepared to buy, sell, or hold shares based on market conditions and your investment goals.

3.5. Consider Tax Implications

Be aware of potential capital gains taxes on profits from selling shares. The IRS provides guidance on capital gains tax rates and regulations.

4. Alternative Investment Avenues in Football

If buying individual club shares seems too risky, consider these alternatives:

4.1. Investment Trusts and Funds

Invest in trusts or funds that hold shares in multiple football clubs. This diversifies your investment and reduces risk. An example is the Finsbury Growth & Income Investment Trust, which has holdings in Manchester United and Juventus.

4.2. Memorabilia

Purchase football memorabilia, such as signed shirts or collectible cards. While potentially valuable, these items are less liquid than shares.

4.3. Sponsor Companies

Invest in publicly traded companies that sponsor football clubs. For example, Adidas is a long-running kit supplier for Manchester United.

5. The Bottom Line: Informed Investing for Passionate Fans

Investing in football clubs can be a thrilling way to connect with your favorite team. However, it’s essential to approach it as you would any other investment – with careful research, a clear understanding of the risks, and a well-defined strategy.

Here’s a table summarizing key publicly listed football clubs:

| Club | Stock Exchange | Ticker |

|---|---|---|

| Manchester United | New York Stock Exchange | MANU |

| Juventus F.C. | Milan Stock Exchange | JUVE |

| Celtic F.C. | London Stock Exchange | CCP |

| Borussia Dortmund | Xetra (German Exchange) | BVB |

| A.S. Roma | Milan Stock Exchange | ASR |

Remember, past performance is not indicative of future results. Market conditions, team performance, and financial management all play a role in the success of these investments.

Are you feeling overwhelmed by the options and risks? Do you want personalized advice tailored to your financial situation and passion for the game? CAUHOI2025.UK.COM is here to help! Our team of experts can provide you with the insights and guidance you need to make informed decisions.

Don’t let your passion lead to financial missteps. Visit CauHoi2025.UK.COM today to explore more answers, ask your own questions, and even connect with a financial advisor. Take control of your investment journey and support your team the smart way!

For more information, contact us at our U.S. office: Equitable Life Building, 120 Broadway, New York, NY 10004, USA, or call us at +1 (800) 555-0199.

FAQ: Investing in Football Clubs

Q1: Can I buy shares in any football club?

No, only clubs that are publicly listed on a stock exchange offer shares to the public.

Q2: What are the risks of investing in football clubs?

Risks include high operating costs, performance-based share price volatility, and external market factors.

Q3: How do I buy shares in a football club?

Open a brokerage account, choose an investment strategy, place an order, and monitor your investment’s performance.

Q4: What are some alternative ways to invest in football?

Consider investment trusts and funds, memorabilia, or sponsor companies.

Q5: Are dividends guaranteed when investing in a football club?

No, dividend payments are not guaranteed and can be suspended.

Q6: Where can U.S. investors buy shares of European football clubs?

Through international brokerage accounts that provide access to exchanges like the London Stock Exchange or Milan Stock Exchange.

Q7: How does on-field performance affect share prices?

Positive results can lead to increased investor confidence and higher share prices, while poor performance can have the opposite effect.

Q8: What is market capitalization?

Market capitalization is calculated by multiplying a company’s share price by the number of shares in circulation, indicating the company’s overall value.

Q9: What is dollar-cost averaging?

Dollar-cost averaging involves investing a fixed amount regularly to mitigate risk in a volatile market.

Q10: What are capital gains taxes?

Capital gains taxes are levied on profits from selling shares, and rates are set by the IRS.