A Coordinated Approach What are the challenges in ensuring that measures taken against offshore tax havens do not disproportionately affect legitimate financial activities or developing countries?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

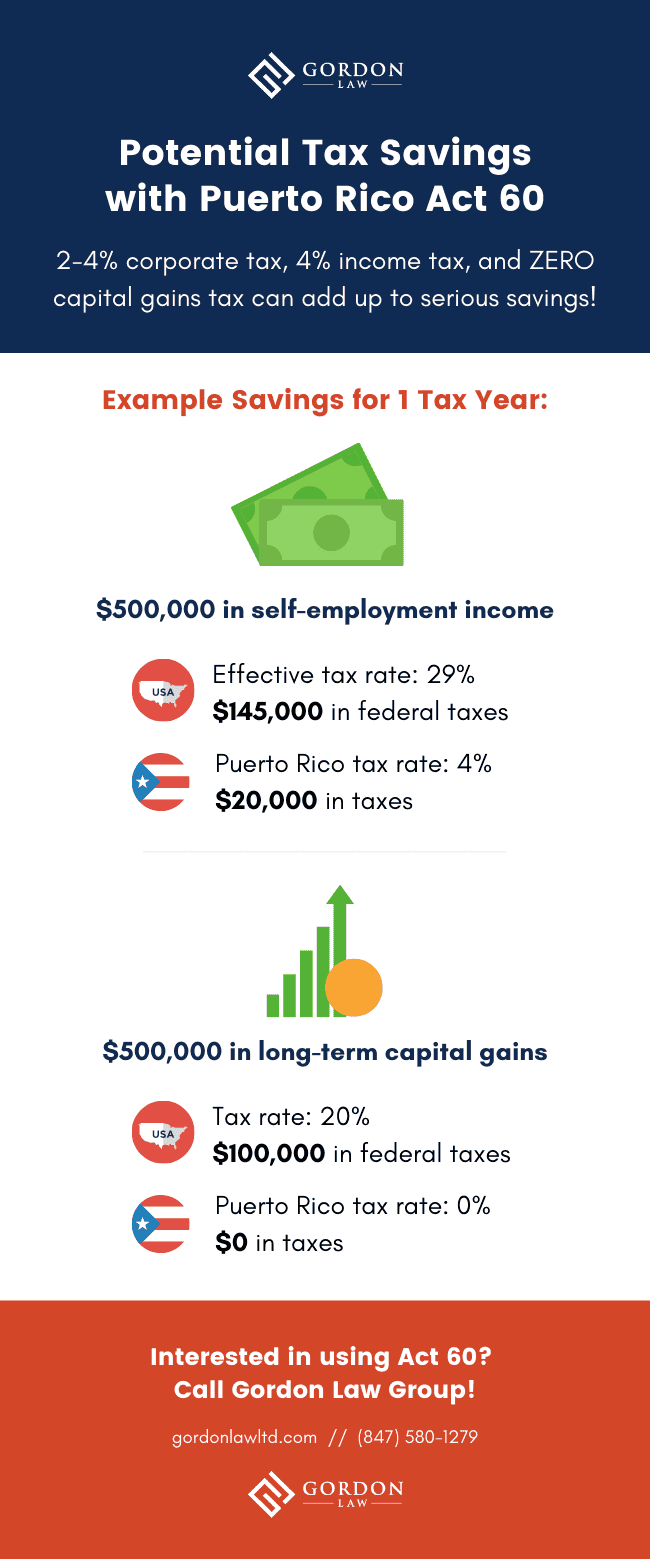

what are offshore tax havens Informational

- Making Institutions Responsible What are the potential benefits of greater international tax cooperation for achieving the Sustainable Development Goals (SDGs)?

- Combating Corruption in Government How can the international community work together to develop more effective mechanisms for resolving international tax disputes, including those related to the use of offshore tax havens?

- Legal and Reputational Risks How can the use of offshore tax havens lead to legal trouble?

- The Role of Insiders

- Protecting Global Finance What are the potential benefits of greater transparency and accountability

- Amplifying Developing Country Voices What are the potential impacts of technological advancements, such as artificial intelligence and blockchain, on the future of tax havens and their regulation?

- Regional Cooperation

- Understanding the Concept What is the legal definition of an offshore tax haven?

- Adapting to Change How might increasing scrutiny and regulation impact the attractiveness of tax havens?

- Making Them Bite What are the ethical considerations for individuals who choose to use offshore tax havens for tax planning?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.