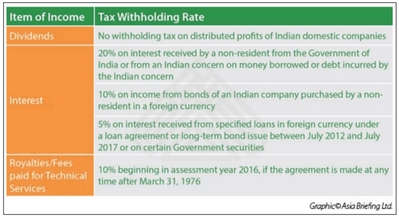

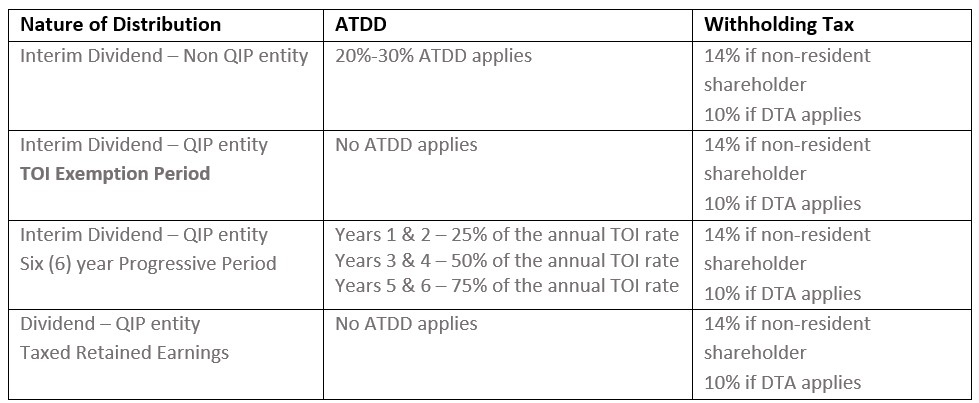

What are the withholding tax rules for payments related to telecommunications services? How does resident withholding tax apply to payments for utilities?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

what is resident withholding tax

- How does resident withholding tax apply to payments made for social services and welfare? What are the specific withholding tax rules for payments related to arts and culture?

- How does resident withholding tax interact with value-added tax (VAT)? How does resident withholding tax interact with sales tax?

- What are the specific withholding tax rules for payments related to digital content creation and distribution technology? How does resident withholding tax apply to income earned in the digital content creation and distribution technology sector?

- What are the specific withholding tax rules for payments related to space technology (SpaceTech)?

- How does resident withholding tax apply to income earned in the SpaceTech sector? What are the withholding tax rules for payments related to maritime technology (MarineTech)?

- How does resident withholding tax apply to payments made for media and entertainment services? What are the withholding tax rules for payments related to journalism and broadcasting?

- What are the rules for withholding tax on deferred compensation? How does resident withholding tax affect stock options and other equity-based compensation?

- What are the specific withholding tax rules for payments related to repair and maintenance of equipment?

- How does resident withholding tax apply to payments related to intellectual property? What are the withholding tax rates for different types of intellectual property income?

- What are the withholding tax rules for payments related to influencer marketing and social media technology?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.