What is the difference between a deduction and an offset How do bonuses and commissions get taxed and reflected on a paystub

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

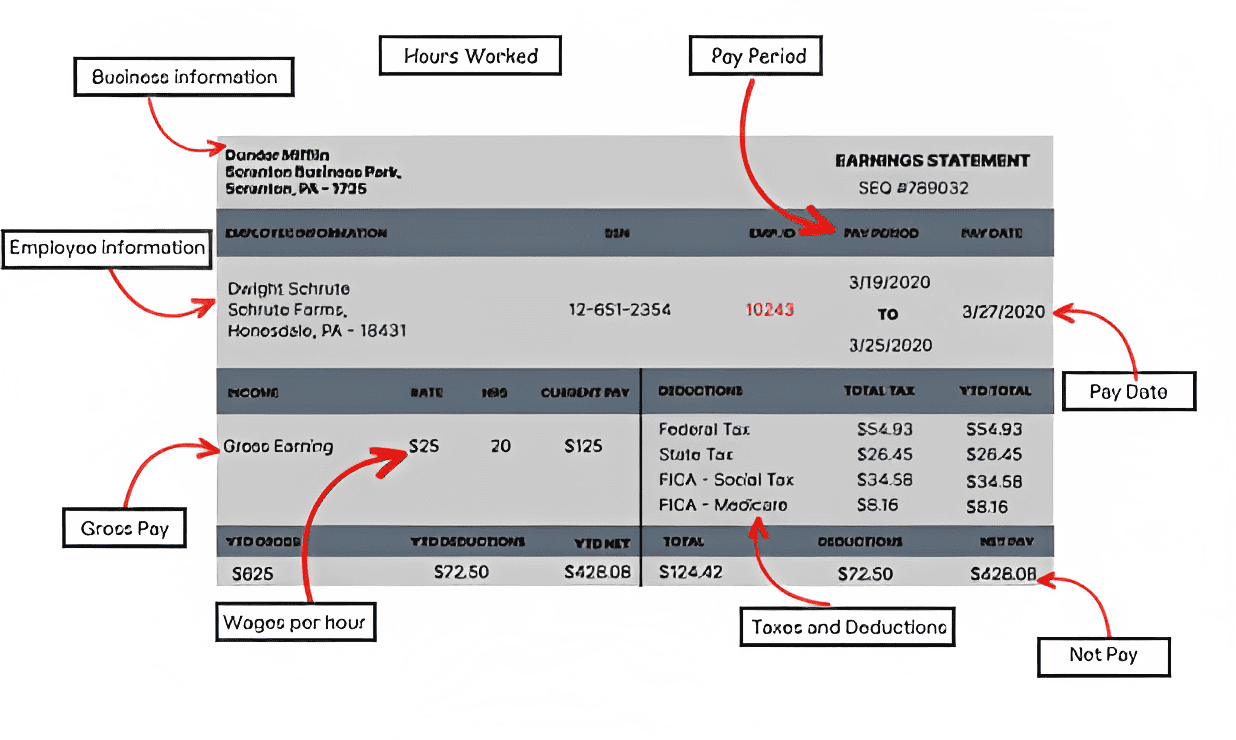

what is paystub

- For how long should I keep my paystubs

- What are qualified retirement plans and how do contributions to them affect my paystub What are non-qualified retirement plans and how do contributions to them differ on a paystub How do health savings accounts (HSAs) work and how are contributions shown on a paystub in terms of taxability What are the rules for contributing to and withdrawing from an HSA and how does this relate to paystub deductions How do flexible spending accounts (FSAs) work and how are contributions deducted on a paystub What are the "use-it-or-lose-it" rules for FSAs and how does this relate to my paystub deductions What are dependent care FSAs and how do contributions appear on my paystub What are transportation fringe benefits and how might they be reflected on my paystub in terms of taxability What are qualified moving expense reimbursements and how do they appear (or not appear) on a paystub after tax law changes What are educational assistance programs offered by employers and how might they affect my paystub or W-2 What are adoption assistance programs and how might they relate to my paystub or tax forms How do life insurance benefits provided by my employer (beyond a certain amount) get taxed and potentially shown on a paystub What are the tax implications of disability insurance benefits paid by my employer and how might this relate to my paystub How does workers' compensation differ from disability insurance in terms of taxability and impact on a paystub (if any) What are unemployment insurance benefits and how do they relate to my past paystubs and taxes How are tips taxed, and how does my employer handle the reporting and withholding on my paystub What is the difference between reported tips and allocated tips on a paystub and for tax purposes If I am a tipped employee, how can I ensure my paystub accurately reflects my earnings and withholdings What are the employer's responsibilities regarding the reporting and withholding of taxes on tips What are my responsibilities as a tipped employee for reporting my income What happens if my reported tips are less than the allocated tips amount on my W-2 How does the Affordable Care Act (ACA) affect the information that might appear on my paystub or W-2 related to health insurance coverage What are the employer shared responsibility provisions under the ACA and how might they indirectly relate to my paystub What are Form 1095-B and Form 1095-C and how do they relate to the health insurance information that might be relevant to my paystub and taxes If I work for a non-profit organization, will my paystub look different than if I worked for a for-profit company Are the tax withholdings and deductions the same for employees of non-profit organizations How do contributions to tax-deferred annuities (like a 403(b) for non-profits) appear on a paystub What if I work for a government agency; will my paystub have any unique features Are the tax rules and withholdings different for government employees in some cases How do pension contributions (if offered) appear on a government employee's paystub What if I work in a different country for a US-based employer; how will my paystub and tax situation be affected Are there tax treaties between the US and other countries that might affect my paystub What are foreign earned income exclusions and how might they relate to my pay if I work abroad What are the implications of being a US citizen or resident working abroad on my US tax obligations and paystub If I am a foreign national working in the US, what tax rules and withholdings apply to my paystub What is a Social Security number (SSN) and why is it important for my paystub and tax purposes What is an Individual Taxpayer Identification Number (ITIN) and when might it be used instead of an SSN for payroll What are the potential consequences of providing incorrect personal information (like SSN or address) to my employer for payroll How can I update my personal information with my employer to ensure my paystubs are accurate What is the importance of having the correct mailing address on file with my employer, especially for receiving year-end tax forms like W-2 How often should I check my personal information on my paystub for accuracy What are the common mistakes that employees should look for when reviewing their paystubs What are common mistakes that employers might make when generating paystubs If I identify an error on my paystub, what is the best way to communicate this to my employer What documentation should I provide to my employer when reporting a paystub error What is a reasonable timeframe for my employer to correct a paystub error What recourse do I have if my employer fails to correct a paystub error Are there government agencies I can contact if I have issues with my pay or paystub that my employer is not resolving What is the statute of limitations for filing a wage claim if I believe I have been underpaid What types of compensation are typically covered under wage and hour laws What are the rules regarding minimum wage and overtime pay under federal and state laws and how do these relate to my paystub How can I track my hours worked if I am an hourly employee to verify the accuracy of my paystub What are timekeeping systems that employers might use, and how can employees ensure their hours are being recorded correctly What if my employer requires me to work off the clock; is this legal and how would it affect my paystub What are break time rules and how should they be reflected (paid or unpaid) on my paystub for hourly employees What are the rules regarding deductions for uniforms or equipment, and can these deductions reduce my pay below minimum wage What are the rules regarding final paychecks when I leave a job, and what information should be included on that paystub What if I am laid off or terminated; when should I expect my final paystub and are there any specific requirements for it What is unused vacation time, and am I entitled to be paid for it when I leave my job, and how would this appear on my final paystub What are severance packages and how are they typically paid and taxed (related to paystub implications) What are non-compete agreements and how might they indirectly affect my future pay or paystub from a new employer What are confidentiality agreements and how are they unrelated to the details on a paystub What are intellectual property agreements and how are they unrelated to the details on a paystub What are arbitration agreements and how are they unrelated to the details on a paystub What are employee handbooks and where can I find information about pay policies that might not be detailed on my paystub How do performance reviews relate to my pay and potential changes that would be reflected on future paystubs What are merit-based raises and how will they be shown on my paystub What are cost-of-living adjustments (COLAs) and how will they appear on my paystub What are step increases (common in government or union jobs) and how will they be reflected on my paystub What are longevity bonuses and how will they be paid and taxed (related to paystub) What are referral bonuses and how will they be paid and taxed (related to paystub) What are signing bonuses and how are they typically taxed and shown on the first few paystubs What is the difference between exempt and non-exempt employees under the FLSA, and how does it affect overtime pay and related information on a paystub How is "hours worked" defined for non-exempt employees under the FLSA for the purpose of calculating overtime What are the different ways overtime pay can be calculated (e.g., daily vs. weekly) and how is this reflected on a paystub What are blended overtime rates and when might they apply, and how are they shown on a paystub What are the record-keeping requirements for overtime hours worked under the FLSA Can an employer pay a flat sum for overtime instead of calculating hourly overtime based on the regular rate of pay (and how would this appear on a paystub) What are compensatory time (comp time) arrangements in lieu of overtime pay, and are they legal in all sectors (and how would this be tracked and potentially reflected, though not directly as pay, related to paystubs) What are independent contractors, and why do they not receive paystubs as traditional employees do What tax form do independent contractors typically receive instead of a W-2, and how does this relate to the income information they would have tracked (which a paystub does for employees) What are the key differences in how taxes (income tax, Social Security, Medicare) are handled for employees versus independent contractors (and why employees have withholdings on their paystubs) What is self-employment tax that independent contractors are responsible for, and how does this contrast with the employee and employer portions of FICA tax shown on a paystub What are estimated tax payments that independent contractors may need to make quarterly to cover their income tax and self-employment tax liabilities (in lieu of withholdings on a paystub) What kind of records should independent contractors keep to track their income and expenses for tax purposes (similar to how a paystub helps employees track income) If an employer misclassifies an employee as an independent contractor, what are the implications for the worker regarding taxes, benefits, and documentation (like the absence of a paystub) How can a worker determine if they are correctly classified as an employee or an independent contractor under the law What are the potential penalties for employers who misclassify employees as independent contractors If a worker believes they have been misclassified, what steps can they take to address this issue How do gig economy workers fit into the employee vs. independent contractor classification, and what kind of pay documentation do they typically receive (which may or may not resemble a traditional paystub) What are platform companies doing to provide earnings summaries to gig workers, and what information do these summaries typically include (compared to a paystub) What are the tax obligations of gig workers, and how do they manage their income reporting and tax payments without regular paystubs and withholdings Are there any efforts to provide more traditional paystub-like documentation or benefits for gig economy workers How do the concepts of gross pay, deductions, and net pay apply (even if not formally called that) to the earnings of independent contractors and gig workers What types of expenses can independent contractors typically deduct to reduce their taxable income (similar to how pre-tax deductions reduce an employee's taxable income on a paystub) How does health insurance work for independent contractors and gig workers (since they don't typically have employer-sponsored plans with payroll deductions shown on a paystub) How do retirement savings work for independent contractors and gig workers (without employer contributions or payroll deductions seen on an employee's paystub) What resources are available to help independent contractors and gig workers manage their finances, taxes, and record-keeping (since they don't have the structure of a traditional employer and paystub) How might changes in employment status (e.g., from employee to contractor or vice versa) affect the documentation of pay received (paystub vs. Form 1099) and tax obligations What if I receive both a regular paycheck (as an employee) and payments reported on a 1099 (for freelance work) from the same company; how will this be documented and taxed How does the information on my paystubs relate to other financial documents I might receive from my employer, such as W-2s, 1099s, or benefit statements Can I use my paystubs to reconcile the income information provided on my W-2 at the end of the year What should I do if the year-to-date totals on my final paystub of the year do not match the information on my W-2 How do benefit statements (e.g., for health insurance or retirement plans) relate to the deductions shown on my paystub If I contribute to a retirement plan through payroll deductions, how can I track the growth of my investments (usually through separate statements, not the paystub itself) How does the cost of employer-provided benefits (that are not deducted from my pay, like employer contributions to health insurance) get reported to me (often on the W-2, not the paystub)? What are total compensation statements that some employers provide, and how do they offer a broader view of my earnings and benefits beyond just what's on a paystub How can I use my paystubs to create a budget and track my income and expenses What are budgeting tools or apps that can help me analyze the information on my paystubs How can I use my paystubs to plan for future financial goals, such as saving for a down payment or retirement If I lose my job, how can I use my past paystubs to help with my unemployment application What information from my paystubs is typically required when applying for unemployment benefits How can my paystubs serve as documentation of my earnings history for various purposes If I am asked to provide proof of income, what is the typical timeframe of paystubs that are requested (e.g., most recent, last few months) What if my pay frequency changes (e.g., from bi-weekly to semi-monthly); how will this be reflected on my paystubs What if my work location changes (especially if it's to a different state with different tax laws); how will this affect my paystub What if there are changes in federal or state tax laws; how will my employer implement these changes and how will they be reflected on my paystub How will changes in my marital status or number of dependents (if I update my W-4) impact the tax withholdings on my paystub What if I start or stop contributing to a pre-tax deduction (like a 401(k) or health insurance); how will this change be visible on my paystub What if I receive a one-time bonus or special payment; how will it be taxed and shown on my paystub (it might be separate or included with regular wages) What if I receive back pay for previous periods; how will this be handled on my paystub in terms of taxation and reporting What are the implications of having wages garnished due to a court order or other legal process, and how will these deductions appear on my paystub What are student loan garnishments and how are they processed through payroll and shown on my paystub What are child support or alimony garnishments and how do they appear as deductions on my paystub Are there limits to the amount that can be garnished from my wages What legal protections do I have regarding wage garnishment If I have multiple garnishments, how does my employer prioritize them What if I move to a different state while still working for the same employer; how will state tax withholdings be handled on my paystub What are local income taxes (city or county) and how would they be withheld and shown on my paystub if applicable How can I find out if I am subject to local income taxes based on where I live or work What are state-specific payroll taxes or deductions that might appear on my paystub (beyond just state income tax) What resources are available at the state level to help employees understand their paystubs and wage rights Are there any differences in paystub requirements or information provided in different states What if my employer is located in a different state than where I work; which state's laws regarding paystubs apply How do tax reciprocity agreements between states affect state income tax withholdings on my paystub if I live in one state and work in another What are the potential consequences for an employer who fails to comply with state-specific paystub laws Where can I report an employer for violating paystub laws in my state Are there any federal laws that preempt state laws regarding paystubs What is the role of the Department of Labor (both federal and state) in enforcing wage and hour laws and paystub requirements How can I file a complaint with the Department of Labor if I have issues with my pay or paystub What information should I include when filing a wage and hour complaint What is the process for investigating a wage and hour complaint What are the potential outcomes of a wage and hour investigation Are there legal resources or attorneys who specialize in wage and hour disputes What is a class action lawsuit related to wage and hour violations How can I learn more about my rights as a worker regarding pay and paystubs Are there any advocacy groups or worker rights organizations that provide information and assistance on these topics How do unions help their members understand their paystubs and ensure fair pay practices What role do collective bargaining agreements play in determining pay and the information included on paystubs for union members Are there any specific terms or codes that are commonly found on union paystubs that employees should be aware of How can I find out if my workplace is unionized and who to contact for information What are apprenticeship programs and how do the paystubs of apprentices differ from those of fully qualified workers What are prevailing wage laws (like the Davis-Bacon Act) and how do they affect the pay and paystubs of workers on certain government contracts What are the rules regarding deductions for tip pools in workplaces where tipping is common, and how should these be reflected on a paystub What are service charges and how do they differ from tips, and how might they appear (or not appear) on a paystub What are commissions-based jobs and how are earnings and deductions typically shown on a paystub for these roles (it can be more variable) How are draws against future commissions handled and shown on a paystub What are clawbacks of commissions or bonuses, and how would these appear as deductions on a paystub What are phantom stock plans and how do they relate to employee compensation, even if not directly reflected on regular paystubs What are stock appreciation rights (SARs) and how are they related to employee compensation and potential future payments that might have tax implications relevant to paystub information How do employee recognition programs or awards that include cash payments get processed through payroll and appear on a paystub What are de minimis fringe benefits that are not taxable and therefore might not appear on a paystub What are qualified transportation fringe benefits (e.g., for commuting) and how do they get reflected on a paystub in terms of taxability What are qualified moving expense reimbursements (under current law) and how do they appear on a paystub What are qualified retirement planning services provided by an employer and how do they relate to the employee's overall financial well-being beyond just the paystub How can I use the information on my paystubs to help me with tax planning throughout the year Should I adjust my W-4 withholdings if I experience significant changes in my income or deductions What are the risks of under-withholding or over-withholding taxes based on my paystubs How can I use an IRS withholding estimator to help me determine the correct amount of taxes to withhold from my paychecks What are the deadlines for submitting W-4 changes to my employer to affect my paystub in a timely manner How do tax credits I may be eligible for (like the Earned Income Tax Credit) relate to the amount of taxes withheld from my paystub Can I request to have additional amounts withheld from my paychecks for taxes beyond what my W-4 indicates What is the impact of the Alternative Minimum Tax (AMT) on my tax liability and how might it indirectly relate to my paystub withholdings How does the taxation of investment income differ from wage income as shown on a paystub If I have income from sources other than my job (e.g., investments, rental income), how should I factor this into my tax planning and W-4 adjustments to avoid under-withholding What are the potential penalties for underpayment of taxes, and how can reviewing my paystub help me avoid these penalties How does the information on my paystub relate to the tax forms I will need to file at the end of the year (e.g., Form 1040) What are the different schedules that might need to be filed with Form 1040 based on the types of income and deductions reflected (or not reflected) on my paystub How can I find a qualified tax professional who can help me understand the tax implications of my paystub and other income sources What are the costs associated with hiring a tax professional, and when might it be beneficial to do so Are there free tax preparation services available for individuals with lower incomes, and how can they help with understanding paystub and W-2 information What are the resources available on the IRS website (irs.gov) to help taxpayers understand their paystubs and tax obligations Are there any common tax myths related to paychecks and withholdings that I should be aware of How does the concept of tax basis relate to items that might be deducted from my pay on a pre-tax basis (e.g., retirement contributions) What is the difference between a tax deduction and a tax credit, and how do they ultimately affect my tax liability beyond just the withholdings on my paystub How do state tax credits and deductions (if applicable) affect my overall state tax liability beyond what's withheld on my paystub What are the deadlines for filing federal and state income tax returns each year What happens if I need to file an extension for my tax return What are the record-keeping requirements for tax purposes, and how long should I keep my paystubs and other income-related documents What are the potential consequences of filing an inaccurate tax return What is tax fraud and how can I avoid it when dealing with my paystub and other financial information How can I protect my personal and financial information related to my paystubs from identity theft What should I do if I suspect my paystub information has been compromised Are there any specific security measures I should take when accessing digital paystubs online What are the risks of sharing my paystub information with unauthorized individuals or entities Why do lenders and landlords often request paystubs as part of an application process What information from my paystub are they typically interested in (e.g., gross pay, net pay, employer, pay frequency) How many paystubs do they usually require as proof of income What if my income fluctuates; how can I provide adequate proof of income using my paystubs What if I recently started a new job and only have one or two paystubs; what other documentation might be required If I am self-employed, what alternatives to paystubs can I provide as proof of income How can I verify the authenticity of a paystub if I receive it from someone else as proof of income Are there any red flags to look for on a paystub that might indicate it is fraudulent or altered What are the legal consequences of creating or using a fake paystub How can employers verify the paystub information of job applicants What role do third-party verification services play in confirming employment and income details How do paystubs relate to other forms of compensation I might receive, such as bonuses, stock options, or benefits If I receive a bonus, will it be included in my regular paycheck or issued separately, and how will the tax withholdings work How are stock options taxed when they are granted, vest, or exercised, and how might this eventually be reflected in my tax-related documents connected to my employment What are restricted stock units (RSUs) and how are they taxed when they vest and distributed (which would have implications for payroll and tax reporting) How do employee stock purchase plans (ESPPs) work and what are the tax implications of purchasing shares at a discount (which would be relevant for payroll and year-end tax forms) How are employer contributions to retirement plans (like 401(k) matching) reported to employees (usually on statements, not the paystub itself) What are the tax advantages of contributing to employer-sponsored retirement plans through payroll deductions What are the contribution limits for various retirement plans, and how can I track my contributions through my paystubs and other statements How do health savings accounts (HSAs) offer tax advantages, and how are contributions through payroll handled What are the rules for withdrawing funds from an HSA, and how does this relate to the initial tax benefits of contributing through my paystub How do flexible spending accounts (FSAs) work for healthcare and dependent care expenses, and how are contributions deducted from my pay on a pre-tax basis What are the limits for FSA contributions, and what happens to unused funds at the end of the plan year What other types of benefits might be offered by my employer, and how might their value or cost be reflected (or not reflected) on my paystub How can I get a better understanding of my total compensation package, including salary, benefits, and other perks, beyond just looking at my paystub Should I review my benefits elections periodically to ensure they still meet my needs and that the deductions on my paystub are correct What happens if I experience a life event (like marriage, birth of a child) that might affect my benefits and tax withholdings, and how do I make changes that will be reflected on my paystub How can I contact my employer's HR or payroll department if I have questions about my paystub or benefits What resources does my employer provide for understanding my paystub and benefits (e.g., online portals, FAQs) What are the common acronyms and abbreviations I might see on my paystub related to taxes and deductions What is the difference between "This Period" and "Year-to-Date" amounts on my paystub How can I use the YTD amounts on my paystub to track my income and deductions throughout the year What is the typical format and layout of a paystub in the United States Are there any mandatory information fields that must be included on a paystub in most states How can I distinguish between different types of deductions (pre-tax, post-tax) on my paystub How are taxes usually listed on a paystub (e.g., federal, state, FICA) What are earnings usually listed as on a paystub (e.g., regular, overtime, bonus) Where can I typically find my pay rate and hours worked on an hourly paystub Where can I typically find my salary and pay period on a salaried paystub How is paid time off (PTO) accrual usually displayed on a paystub What is the difference between the "Employee Information" and "Employer Information" sections of a paystub What is the significance of the "Check Number" or "Paycheck Number" on a paystub What is the "Pay Date" versus the "Pay Period End Date" on a paystub What is a "Stub Date" and how does it relate to the pay date Why is it important to keep track of all of my paystubs throughout my employment In what situations might I need to provide copies of my paystubs to third parties How long should my employer retain records of my paystubs after I leave the company What are the rules regarding access to past paystubs if I no longer work for a company Can I request copies of old paystubs from a former employer, and is there a fee for this What legal obligations do employers have to maintain and provide pay records to current and former employees What if my employer goes out of business; how can I access past paystub information if needed How do paystubs differ from W-2 forms, and what is the purpose of each document When do employers typically issue W-2 forms to employees each year What information from my paystubs

- What is Medicare tax What is the current Medicare tax rate

- What if I work overtime occasionally; how will this be shown on my paystub What are the differences I might see on a paystub from a small company versus a large company

- How is state income tax calculated

- What are the benefits of digital paystubs

- What are employer contributions (separate section)

- Are paystub calculators always accurate What are the limitations of paystub calculators

- What are the implications of having tax-deferred retirement contributions on my current paystub and future taxes How do pre-tax health insurance premiums affect my taxable income on my paystub What are the advantages of having pre-tax deductions

- Are there online paystub calculators available How do paystub calculators work

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.