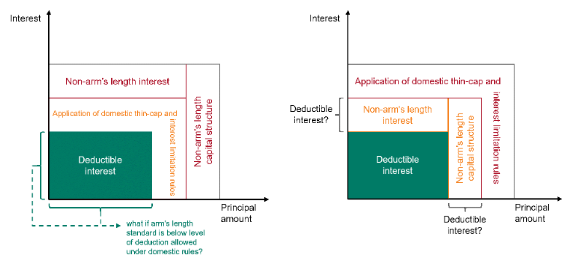

What are the transfer pricing considerations for transactions involving controlled foreign corporations (CFCs)? How do CFC rules interact with transfer pricing regulations?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

what is a non arm's length transaction

- What are the transfer pricing considerations for contract research and development arrangements? How are the costs and risks of contract R&D allocated between related parties?

- What are the limitations of the resale price method in the context of non-arm's length transactions?

- How should the contributions and expected benefits be measured in a cost contribution arrangement involving related entities? What are the transfer pricing considerations for transactions involving the licensing or transfer of software and other digital content between related parties?

- What are the challenges in performing accurate benchmarking studies for unique non-arm's length transactions? How can third-party data be used to support the arm's length nature of related-party transactions?

- How are the residual values of leased assets determined in related-party transactions? What are the transfer pricing considerations for the transfer of tangible property between related entities?

- How do small and medium-sized enterprises (SMEs) approach transfer pricing for their non-arm's length transactions? Are there simplified transfer pricing rules available for SMEs in some jurisdictions?

- How is the value of goodwill determined in related-party transfer transactions?

- How should the fees for related-party procurement services be determined under the arm's length principle? What are the transfer pricing considerations for transactions involving the provision of supply chain management services between related entities?

- What are the transfer pricing considerations for transactions involving research and development activities conducted collaboratively by related parties? How should the costs, risks, and rewards of collaborative R&D be allocated between related entities for transfer pricing purposes?

- What are the practical challenges in obtaining correlative relief in cross-border transfer pricing disputes?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.