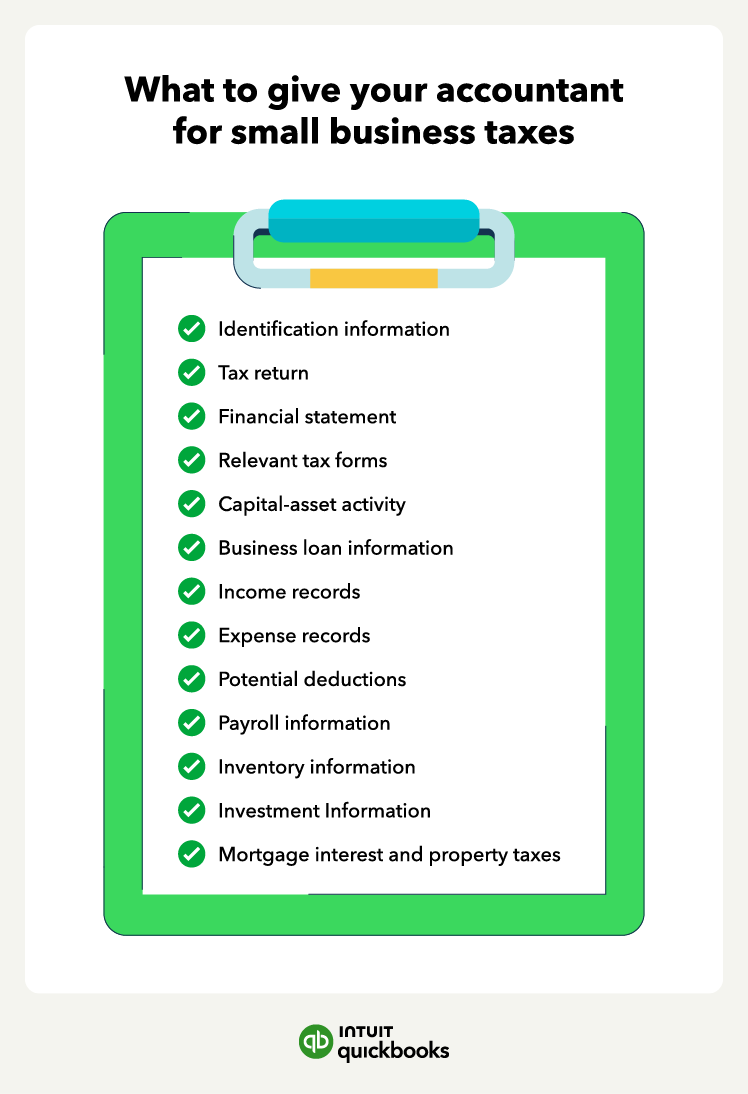

explain the role of qualifying capital expenditure in enhancing technology and innovation. what are the considerations for classifying capital expenditure when assets are exchanged or traded?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

what is qualifying capital expenditure Informational

- discuss the strategic implications of investments in qualifying capital expenditure. can training costs related to new equipment qualify as capital expenditure?

- under what conditions might the expenses of localizing software or manuals be considered qualifying capital expenditure?

- discuss the potential links between qualifying capital expenditure and executive incentives. can costs related to the development of internal-use software that improves administrative efficiency qualify as capital expenditure?

- provide examples of such costs that could potentially qualify as capital expenditure. how does qualifying capital expenditure affect a company's ability to adapt to changes in consumer demand or market trends?

- explain how credit rating agencies might view investments in qualifying capital expenditure. what are the considerations for classifying capital expenditure when assets are constructed in-house?

- discuss the risks associated with the incorrect treatment of capital expenditure. how does qualifying capital expenditure differ across different countries or jurisdictions?

- can investments in automation or new technologies necessitate changes in staffing or organizational design?

- provide examples of such costs that could potentially qualify as capital expenditure. how does qualifying capital expenditure affect a company's ability to comply with regulatory requirements and industry standards?

- how is qualifying capital expenditure determined when the purchase price is not paid upfront?

- under what circumstances might the costs of legal and professional services associated with asset purchases be considered qualifying capital expenditure?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.