explain how investments in qualifying capital expenditure can impact a company's ROI. what are the common mistakes companies make when classifying capital expenditure?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

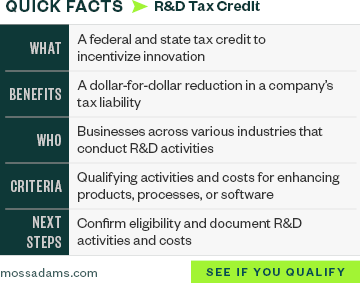

what is qualifying capital expenditure Informational

- discuss any specific rules related to qualifying capital expenditure in like-kind exchanges. can costs related to the remediation of environmental contamination caused by past operations qualify as capital expenditure?

- under what conditions might the expenses of training customers on newly acquired assets be considered qualifying capital expenditure?

- under what conditions might the expenses of training employees on updated safety protocols for new assets be considered qualifying capital expenditure?

- explain the relationship between qualifying capital expenditure and geographic growth. what are the considerations for classifying capital expenditure when assets are acquired through a barter transaction or non-monetary exchange?

- provide examples of such costs that could potentially qualify as capital expenditure. how does qualifying capital expenditure affect a company's resilience to economic downturns or unexpected disruptions?

- what is the relationship between qualifying capital expenditure and a company's profit margins?

- under what conditions might expenditures that enhance the appearance or usability of existing assets be considered qualifying capital expenditure?

- under what conditions might the expenses of creating initial versions of new products or services be considered qualifying capital expenditure?

- under what conditions might expenditures to upgrade or modify assets for technological advancements be considered qualifying capital expenditure?

- can investments in improved products, services, or customer-facing technologies enhance customer satisfaction and loyalty?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.