What is the purpose of these rules? What are the implications of dividend gross up for shareholders who are non-residents but receive dividends from Canadian corporations?

In Stock

$34.99

$29.99

Shipping and Returns Policy

- Deliver to United States » Shipping Policy «

- - Shipping Cost: $5.99

- - Handling time: 2-3 business days

- - Transit time: 7-10 business days

- Eligible for » Returns & Refund Policy « within 30 days from the date of delivery

Find similar items here:

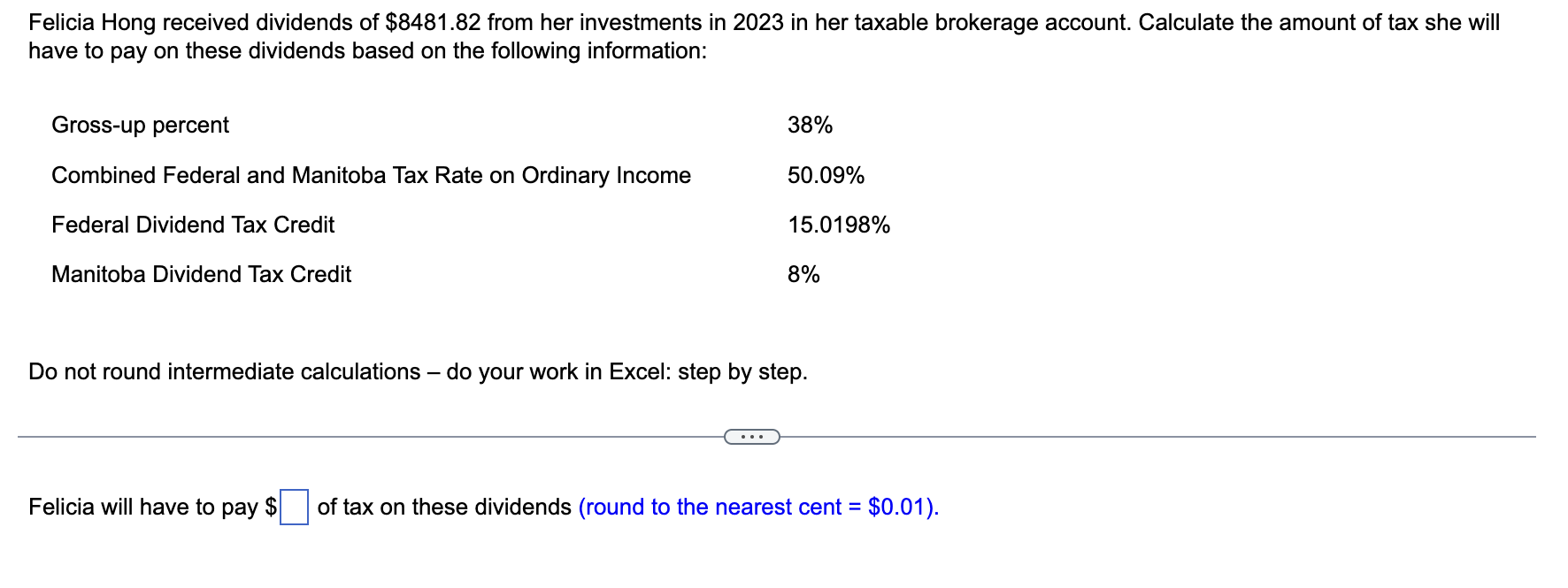

what is dividend gross up Informational

- Are there any limitations on the deductibility of interest? What are the potential implications of the increasing complexity of international tax laws and the global movement towards greater tax transparency on the taxation of dividend income received by Canadian residents from foreign corporations, and how does this interact with the Canadian dividend gross up system for dividends from domestic corporations?

- What is the cost of capital?

- How are dividends distributed by mutual funds taxed? What are the implications of dividend gross up for tax-exempt entities?

- What is the Canada-U.S. Tax Treaty?

- Is the interest expense deductible?

- How does it interact with salary income? How does dividend gross up affect the tax treatment of dividends paid to shareholders who are related to the corporation (e.g., family members)?

- How are capital dividends taxed differently from regular dividends? What are the specific forms and schedules required for reporting dividend gross up on Canadian tax returns?

- How do capital dividends differ from regular dividends? What are the considerations for tax advisors when advising clients who are considering transferring dividend-paying shares to a family trust, in terms of the potential application of the dividend gross up rules and the overall tax implications for the trust and its beneficiaries?

- What are the budgetary implications of changes to dividend gross up rules? How does dividend gross up relate to the concept of fairness in the tax system?

- How does the dividend income interact with the interest expense deduction rules?

-

Next Day Delivery by USPS

Find out more

Order by 9pm (excludes Public holidays)

$11.99

-

Express Delivery - 48 Hours

Find out more

Order by 9pm (excludes Public holidays)

$9.99

-

Standard Delivery $6.99 Find out more

Delivered within 3 - 7 days (excludes Public holidays).

-

Store Delivery $6.99 Find out more

Delivered to your chosen store within 3-7 days

Spend over $400 (excluding delivery charge) to get a $20 voucher to spend in-store -

International Delivery Find out more

International Delivery is available for this product. The cost and delivery time depend on the country.

You can now return your online order in a few easy steps. Select your preferred tracked returns service. We have print at home, paperless and collection options available.

You have 28 days to return your order from the date it’s delivered. Exclusions apply.

View our full Returns and Exchanges information.

Our extended Christmas returns policy runs from 28th October until 5th January 2025, all items purchased online during this time can be returned for a full refund.

No reviews yet. Only logged in customers who have purchased this product may leave a review.