Are you curious about the National Football League’s (NFL) tax status? It’s a question that has sparked considerable debate, especially given the league’s substantial revenues. This article dives into whether the NFL is a nonprofit organization, examining its structure, controversies, and the implications of its tax-exempt status. Discover the facts and gain a clearer understanding of this complex issue with information and resources provided by CAUHOI2025.UK.COM.

1. Understanding the NFL’s Nonprofit Status

Is The National Football League A Nonprofit Organization? The answer is nuanced. The NFL itself, specifically the league office, was structured as a nonprofit under section 501(c)(6) of the Internal Revenue Code. This section applies to trade associations that promote the common interests of their members. However, in 2015, the NFL voluntarily relinquished its tax-exempt status. This decision came amid growing public and political pressure, particularly in light of scandals and controversies surrounding the league.

Why Was the NFL Considered a Nonprofit?

Prior to 2015, the NFL justified its nonprofit status by arguing that it served the common interests of its 32 member teams. The league office managed rules, oversaw referees, and conducted player safety research, all supposedly for the benefit of the teams. This structure allowed the NFL to avoid paying corporate income taxes on its revenue.

What Changed in 2015?

In April 2015, NFL Commissioner Roger Goodell announced that the league would no longer be tax-exempt. He described the tax-exempt status as a “distraction” and said that eliminating it would simplify the league’s operations. While the NFL stopped being a tax-exempt entity, the individual teams continue to operate as for-profit businesses.

2. The Structure of the NFL

To fully understand the NFL’s tax status, it’s essential to grasp its organizational structure. The NFL is not a single entity but rather a collection of various subsidiaries and teams.

For-Profit vs. Nonprofit

The “NFL” consists of several entities, including the for-profit NFL Network and 32 individual teams. In 2012, the NFL generated $9.5 billion in revenue through TV licensing, ticket sales, and merchandise. Most of this revenue flowed through the league’s teams, which then paid dues to the league office.

The Role of the League Office

The league office, previously the nonprofit arm, managed the league’s operations, including rule enforcement, referee oversight, and player safety research. In 2012, the league office received $326 million in dues from the teams.

3. Controversies and Criticisms

The NFL’s nonprofit status was a frequent target of criticism, particularly due to high executive salaries and perceived conflicts of interest.

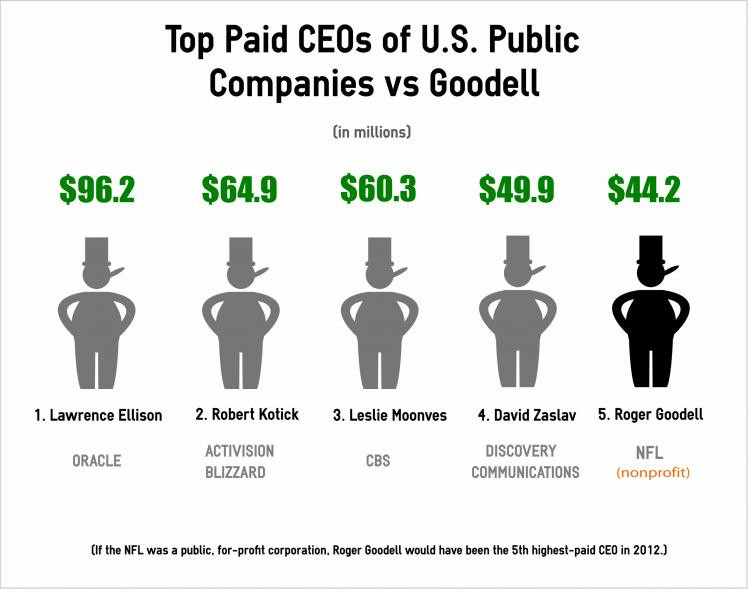

Executive Compensation

One of the most contentious issues was the compensation of NFL Commissioner Roger Goodell. In 2012, Goodell earned $44.2 million, a figure that drew public outrage, especially considering the league’s nonprofit status. Critics argued that such high compensation contradicted the idea of a nonprofit organization.

Comparison with Other Leagues

Even among other nonprofit sports leagues, the NFL’s salaries stood out. For example, the commissioners of the National Hockey League (NHL) and the Professional Golf Association (PGA) Tour each made $8.3 million, significantly less than Goodell’s compensation.

Ethical Concerns

Critics, like Lawrence Lessig, director of the Edmond J. Safra Center for Ethics at Harvard University, argued that the NFL’s tax exemption subsidized a commercial enterprise. Lessig questioned why taxpayers should subsidize an organization making enormous amounts of money.

4. The Legal Perspective

Legal experts have weighed in on whether the NFL truly fit the criteria for a 501(c)(6) organization.

Trade Association Status

To qualify as a 501(c)(6) organization, a group must support the common interests of its industry members. Some experts argued that the NFL’s “trade association” was too exclusive, limited to just 32 teams.

The Midas Muffler Case

Philip Hackney, a former IRS attorney, referenced the 1979 Supreme Court case National Muffler Dealers Assn. Inc. vs. United States. In that case, the court denied nonprofit status to an association of Midas dealers, finding that its focus was too narrow—promoting Midas rather than the broader muffler industry.

IRS Requirements

Hackney argued that the NFL did not fit well into the 501(c)(6) category. While the league engaged in charitable activities, its primary purpose was to promote the NFL brand and its 32 teams.

5. Political Pressure and Legislative Efforts

Growing public anger over NFL scandals led to political pressure and legislative efforts to strip the league of its tax exemption.

Proposed Legislation

Several U.S. Senators introduced bills to revoke the NFL’s tax-exempt status. Senator Tom Coburn (R-Okla.) proposed the Properly Reducing Overexemptions for Sports Act (PRO Sports Act), which would remove nonprofit status from sports organizations with over $10 million in annual revenue.

Grassroots Campaigns

Outside of Congress, grassroots campaigns advocated for the tax exemption’s removal. Rootstrikers, a group opposing the influence of money in politics, launched a campaign supporting Coburn’s legislation. A Change.org petition urging Congress to act garnered over 400,000 signatures.

6. The NFL’s Response and Lobbying Efforts

The NFL has historically maintained its nonprofit status through sophisticated lobbying efforts.

Lobbying Expenditures

According to Open Secrets, the NFL spent nearly $3 million on lobbying over three years. A Sunlight Foundation report revealed that NFL personnel donated $1.5 million to candidates in the 2012 election.

Public Relations

Amid the Ray Rice domestic abuse scandal, the NFL hired Cynthia Hogan, a former counsel to Vice President Joe Biden, to help manage the public relations crisis.

The Influence of NFL Teams

Gregg Easterbrook, author of The King of Sports: Football’s Impact on America, noted the NFL’s active engagement with lobbyists and campaign donations. He suggested that inviting politicians to sit in owners’ boxes created a sense of importance and influence.

7. Financial Impact of Losing Nonprofit Status

Losing its nonprofit status had financial implications for the NFL, though not necessarily devastating ones.

Increased Tax Revenue

Senator Coburn estimated that his proposed changes to the tax code would generate over $109 million in new tax revenue over the next decade.

Shifting Tax Burden

While the NFL itself began paying taxes on its revenue, the individual teams continued to operate as for-profit businesses. This shift primarily affected the league office’s financial structure.

8. The Current Landscape

Today, the NFL operates without the tax-exempt status it once held.

Transparency

One potential benefit of relinquishing its nonprofit status is increased transparency. As a taxable entity, the NFL may be required to disclose more information about its finances, including executive compensation.

Public Perception

The NFL’s decision to give up its tax exemption may have improved its public image, particularly in light of scandals and criticisms.

Ongoing Debates

Despite the change in tax status, debates about the NFL’s financial practices and ethical responsibilities continue. Issues such as player safety, domestic violence, and social activism remain central to these discussions.

9. NFL and Philanthropy

Top paid CEOs of public companies

Top paid CEOs of public companies

The NFL and its teams are involved in various philanthropic efforts.

Charitable Foundations

Many NFL teams have charitable foundations that support community initiatives. These foundations focus on areas such as youth development, education, and health.

Player Involvement

NFL players often engage in charitable activities, donating time and money to various causes. Their efforts can have a significant impact on local communities.

League-Wide Initiatives

The NFL supports league-wide initiatives such as the NFL Foundation, which provides resources for youth football programs and player health and safety research.

10. Future Considerations

The NFL’s financial and ethical landscape is likely to continue evolving.

Potential Tax Reforms

Future tax reforms could impact the financial structure of the NFL and its teams. Changes in tax laws could affect revenue distribution and player compensation.

Social Responsibility

The NFL faces increasing pressure to address social issues such as racial justice, gender equality, and player safety. How the league responds to these issues will shape its public image and long-term success.

Fan Engagement

Maintaining fan engagement is crucial for the NFL’s financial stability. The league must balance its business interests with the needs and expectations of its fans.

FAQ: Is the National Football League a Nonprofit Organization?

Here are some frequently asked questions about the NFL’s nonprofit status:

1. Was the NFL ever a nonprofit organization?

Yes, the league office was structured as a nonprofit under section 501(c)(6) of the Internal Revenue Code until 2015.

2. Why did the NFL give up its nonprofit status?

The NFL relinquished its tax-exempt status due to growing public and political pressure, particularly in light of scandals and controversies.

3. Are NFL teams nonprofit organizations?

No, the individual NFL teams operate as for-profit businesses.

4. What is a 501(c)(6) organization?

A 501(c)(6) organization is a trade association that promotes the common interests of its industry members.

5. How much did NFL Commissioner Roger Goodell make in 2012?

Roger Goodell earned $44.2 million in total compensation in 2012.

6. What was the PRO Sports Act?

The Properly Reducing Overexemptions for Sports Act (PRO Sports Act) was a bill proposed by Senator Tom Coburn to remove nonprofit status from sports organizations with over $10 million in annual revenue.

7. How much did the NFL spend on lobbying?

According to Open Secrets, the NFL spent nearly $3 million on lobbying over three years.

8. What are some of the NFL’s philanthropic efforts?

The NFL and its teams are involved in various philanthropic efforts, including charitable foundations, player involvement, and league-wide initiatives.

9. How might future tax reforms impact the NFL?

Future tax reforms could affect the financial structure of the NFL and its teams, including revenue distribution and player compensation.

10. What social issues does the NFL face pressure to address?

The NFL faces increasing pressure to address social issues such as racial justice, gender equality, and player safety.

Conclusion

While the NFL’s league office once operated as a nonprofit, it relinquished that status in 2015. This decision came amid controversies and criticisms surrounding executive compensation and ethical concerns. Today, the NFL faces ongoing debates about its financial practices and social responsibilities.

Do you have more questions about the NFL or other complex topics? Visit CauHoi2025.UK.COM for clear, reliable answers and expert insights. Our team provides well-researched information to help you understand the issues that matter most. Contact us today to explore further or ask your own questions! Find us at Equitable Life Building, 120 Broadway, New York, NY 10004, USA or call us at +1 (800) 555-0199. We look forward to assisting you.