Want to own a piece of your favorite football club? This guide explains how to buy shares in publicly listed football clubs, the risks involved, and alternative investment options. Get insights and make informed decisions with CAUHOI2025.UK.COM!

Investing in a football club can be more than just a financial decision; it’s often a way for passionate fans to deepen their connection with their beloved team. However, it’s crucial to understand the process, potential risks, and available alternatives before diving in. CAUHOI2025.UK.COM provides you with clear, reliable information to navigate the world of football club investments. In this article, we’ll explore How To Buy Shares In A Football Club, offering insights tailored for U.S. investors. Discover alternative investment strategies and learn how CAUHOI2025.UK.COM can assist you in making informed decisions about football stock, club ownership, and portfolio diversification.

1. Understanding the Landscape of Football Club Ownership

Not all football clubs are publicly traded, meaning their shares can be bought and sold on a stock exchange. Before exploring how to buy shares, it’s essential to know which clubs offer this opportunity.

1.1 Publicly Listed Football Clubs

Several prominent football clubs around the world are listed on stock exchanges. Here are a few examples:

- Manchester United (MANU): One of the most recognizable football brands globally, Manchester United is listed on the New York Stock Exchange (NYSE). Its market capitalization reflects its significant brand value, but like any stock, its price can fluctuate.

- Juventus F.C. (JUVE.MI): This Italian club is listed on the Milan Stock Exchange. Juventus is a major player in Italian football, but its stock performance can be influenced by on-field results and financial performance.

- Borussia Dortmund (BVB.DE): This German club is listed on the Frankfurt Stock Exchange. Known for its strong fan base and competitive performances in the Bundesliga, Borussia Dortmund offers another avenue for investors.

- A.S. Roma (ASR.MI): Another Italian club listed on the Milan Stock Exchange, A.S. Roma, provides investors with exposure to Italian football.

1.2 Factors Influencing Stock Availability

It’s important to note that a club’s public listing status can change. Clubs may delist from exchanges if they are acquired by private owners or undergo significant restructuring. For example, Arsenal was previously listed but is now privately owned.

how to buy shares in a football club

how to buy shares in a football club

2. Why Invest in a Football Club?

For many fans, investing in a football club is driven by passion and a desire to own a piece of their favorite team. However, there are other potential benefits to consider.

2.1 Sentimental Value and Ownership

Buying shares can provide a sense of ownership and connection to the club. Shareholders may receive perks such as voting rights at annual general meetings (AGMs) and the opportunity to influence club decisions.

2.2 Potential Financial Returns

While not the primary reason for most fans, there is potential for financial returns through dividends and capital appreciation. Historically, Manchester United has been the only football club to pay dividends, but these payments can be variable.

2.3 Brand Value and Global Reach

Top football clubs possess strong brand value and global reach, which can translate into revenue through broadcasting rights, merchandise sales, and sponsorships. Investing in these clubs can provide exposure to a growing global sports market.

3. Understanding the Risks Involved

Investing in football club shares carries significant risks. It’s essential to understand these risks before investing any money.

3.1 Financial Volatility

Football clubs face high operating costs, including player salaries, transfer fees, and stadium maintenance. Maintaining profitability can be challenging, and clubs often rely on external funding or owner investment.

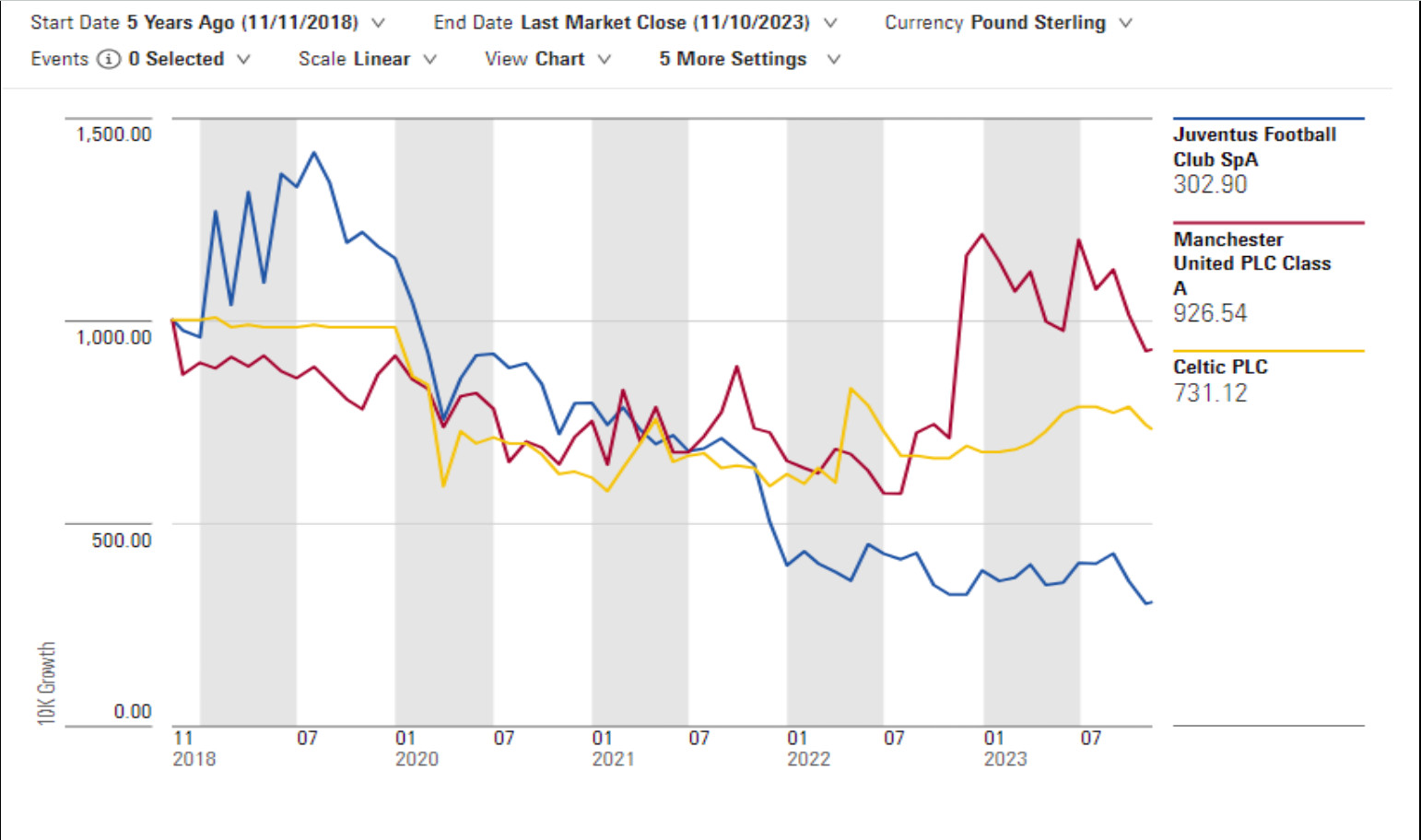

3.2 Performance-Based Fluctuations

A club’s share price can be heavily influenced by its on-field performance. Wins, losses, and qualification for major tournaments can all impact investor sentiment and stock value. These factors are often unpredictable, making football club shares volatile.

3.3 Market Conditions

External factors, such as economic downturns or global events (e.g., the COVID-19 pandemic), can significantly impact club revenues and share prices. Match postponements, reduced attendance, and uncertainty in broadcasting revenues can all negatively affect financial performance.

3.4 Investment Considerations

Russ Mould, investment director at AJ Bell, notes that football clubs often operate like investment banks, generating significant cash when successful but incurring substantial losses during downturns. The high costs of competition often benefit the talent (players) more than the owners or shareholders.

3.5 Prioritizing Financial Health

Before investing in football club shares, ensure you have a solid financial foundation, including an emergency fund covering at least three months of living expenses. For personalized advice, consider reaching out to financial experts in your area, such as those listed on the Financial Industry Regulatory Authority (FINRA) website, to ensure your investment decisions align with your overall financial goals.

4. Steps to Buy Shares in a Football Club

If you’re ready to invest, here are the steps to follow:

4.1 Open an Investment Account

Choose a brokerage firm or online investing platform that offers access to the stock exchange where the football club is listed. Popular options include:

- Online Brokers: Platforms like Fidelity, Charles Schwab, and eToro offer access to global stock markets.

- Investment Apps: Apps like Robinhood and SoFi provide user-friendly interfaces for buying and selling stocks.

Consider factors such as fee structure, range of investments, and user interface when selecting a provider.

4.2 Choose Your Account Type

Decide whether to hold your investments in a general brokerage account or a tax-advantaged account such as an Individual Retirement Account (IRA).

4.3 Fund Your Account

Transfer funds to your investment account via bank transfer, debit card, or other accepted methods. Ensure you meet any minimum deposit requirements.

4.4 Place Your Order

Use the search bar or investment catalog to find the football club’s stock. Enter the number of shares you wish to buy or the amount you want to invest. Many brokerages allow you to set a ‘stop loss’ order to limit potential losses.

4.5 Monitor Your Investment

Regularly monitor your investment performance. Consider buying, selling, or holding shares based on their performance and your investment goals. Be aware of potential tax implications when selling shares, such as capital gains tax.

5. Alternative Investment Strategies

If buying individual football club shares seems too risky, consider these alternative strategies:

5.1 Investment Trusts and Funds

Invest in a trust or fund that includes holdings in multiple football clubs. For example, the Finsbury Growth & Income Investment Trust has included holdings in Manchester United and Juventus in the past.

5.2 Memorabilia

Purchase memorabilia such as signed shirts, footballs, or collectible cards. While these items can increase in value, they offer less liquidity than shares and require finding a buyer.

5.3 Sponsor Companies

Invest in publicly traded companies that sponsor your favorite club. For example, Adidas is a long-running kit supplier for Manchester United.

6. Tax Implications

Investing in football club shares can have tax implications that U.S. investors should be aware of.

6.1 Capital Gains Tax

When you sell shares for a profit, you may be subject to capital gains tax. The tax rate depends on how long you held the shares and your income level. Short-term capital gains (for assets held less than a year) are taxed at your ordinary income tax rate, while long-term capital gains (for assets held longer than a year) are taxed at lower rates.

6.2 Dividends

If the football club pays dividends, you’ll need to report these as income on your tax return. Dividends are typically taxed at a lower rate than ordinary income.

6.3 Wash Sale Rule

Be aware of the wash sale rule, which prevents you from claiming a loss on the sale of stock if you repurchase the same or substantially identical stock within 30 days before or after the sale.

6.4 State Taxes

In addition to federal taxes, you may also be subject to state income taxes on capital gains and dividends, depending on your state of residence.

For personalized tax advice, consult with a qualified tax professional. Resources such as the Internal Revenue Service (IRS) website can provide additional information on investment-related taxes.

7. Staying Informed with CAUHOI2025.UK.COM

Navigating the world of football club investments requires staying informed and making informed decisions. CAUHOI2025.UK.COM can help by providing:

7.1 Reliable Information

CAUHOI2025.UK.COM offers well-researched articles and guides on various investment topics, including football club shares. You can trust the information you find here to be accurate and up-to-date.

7.2 Expert Insights

CAUHOI2025.UK.COM gathers insights from financial experts and industry analysts to provide you with a comprehensive understanding of the investment landscape.

7.3 Personalized Assistance

If you have specific questions or need personalized advice, CAUHOI2025.UK.COM offers consulting services to help you make informed investment decisions.

8. Conclusion: Making Informed Decisions

Investing in a football club can be an exciting way to combine your passion for the sport with financial investment. However, it’s crucial to understand the risks involved and make informed decisions. By following the steps outlined in this guide and staying informed with CAUHOI2025.UK.COM, you can confidently navigate the world of football club investments.

Remember, the key is to approach this investment with your eyes wide open, recognizing both the potential rewards and the inherent risks. As Russ Mould at AJ Bell advises, “Buy the shares for emotional reasons of attachment by all means, but do so with eyes wide open.”

Are you ready to explore more investment opportunities? Visit CAUHOI2025.UK.COM today to discover reliable information, expert insights, and personalized assistance. If you have any questions, don’t hesitate to reach out to us at Equitable Life Building, 120 Broadway, New York, NY 10004, USA or call us at +1 (800) 555-0199. Let CAUHOI2025.UK.COM be your guide to making informed investment decisions!

FAQ: Buying Shares in a Football Club

Q1: What is a publicly listed football club?

A publicly listed football club is a club whose shares are available for purchase on a stock exchange, allowing the public to invest in the team.

Q2: Which football clubs can I buy shares in?

Examples include Manchester United (MANU), Juventus F.C. (JUVE.MI), Borussia Dortmund (BVB.DE), and A.S. Roma (ASR.MI).

Q3: What are the benefits of investing in a football club?

Benefits include a sense of ownership, potential financial returns, and exposure to a global sports market.

Q4: What are the risks of investing in football club shares?

Risks include financial volatility, performance-based fluctuations, and external market conditions.

Q5: How do I buy shares in a football club?

Open an investment account, choose your account type, fund your account, place your order, and monitor your investment.

Q6: What are some alternative investment strategies?

Consider investment trusts and funds, memorabilia, or sponsor companies.

Q7: What are the tax implications of investing in football club shares?

Be aware of capital gains tax, dividends, the wash sale rule, and state taxes.

Q8: Where can I find reliable information about football club investments?

CauHoi2025.UK.COM offers reliable information, expert insights, and personalized assistance.

Q9: Is it better to buy shares in individual clubs or invest in a fund?

Investing in a fund diversifies risk by including multiple clubs, whereas buying individual shares is riskier but may offer higher potential returns.

Q10: What should I consider before investing in a football club?

Assess your financial situation, risk tolerance, and investment goals before investing.