Are you a passionate football (soccer) fan in the U.S. wondering if you can own a piece of your favorite club? This guide explores the ins and outs of buying shares in football clubs, outlining which clubs are publicly traded, the potential risks and rewards, and how to get started. CAUHOI2025.UK.COM provides clear, reliable information to help you make informed decisions about investing in the beautiful game. Discover if owning a slice of your beloved team is right for you and explore alternative investment strategies in sports.

1. Which Football Clubs Offer Publicly Traded Shares?

Not all football clubs are listed on stock exchanges, meaning you can’t buy shares in every team. To invest, the club must be publicly traded, allowing anyone to buy and sell shares freely. Here are some prominent examples:

- Manchester United (MANU): One of the world’s most recognizable football brands, Manchester United is listed on the New York Stock Exchange (NYSE).

- Juventus (JUVE.MI): This Italian giant trades on the Milan Stock Exchange.

- Borussia Dortmund (BVB.DE): A German powerhouse, Borussia Dortmund is listed on the Frankfurt Stock Exchange.

- AS Roma (ASR.MI): Another Italian club, AS Roma, trades on the Milan Stock Exchange.

- Celtic FC (CCP.L): The Scottish club is listed on the London Stock Exchange.

It’s important to check the latest stock listings as club ownership and public offerings can change.

1.1 Delisted Clubs and Private Ownership

Some clubs, like Arsenal in the past, were publicly traded but later returned to private ownership. In Arsenal’s case, this happened when Stan Kroenke became the majority shareholder and delisted the club. Additionally, highly successful clubs such as Manchester City FC are privately owned, meaning their shares are not available to retail investors.

1.2 Market Capitalization: A Key Metric

Market capitalization, calculated by multiplying a company’s share price by the number of shares in circulation, gives you an idea of the club’s overall value. This can be a useful metric when comparing different investment opportunities.

2. Why Invest in a Football Club? Understanding the Motivations

Investing in a football club can stem from several motivations:

- Fan Loyalty: For devoted fans, owning shares represents a deeper connection to their favorite club. It’s a way to feel like a true stakeholder.

- Potential Financial Returns: Like any stock, football club shares can increase in value. However, as discussed below, these investments can be volatile.

- Shareholder Perks: Shareholders may receive perks such as voting rights at annual general meetings (AGMs). Historically, Manchester United has also paid dividends to shareholders, but it paused these payments for the 2023/24 financial year.

2.1 Sentimental Value vs. Investment Strategy

It’s crucial to differentiate between emotional attachment and sound investment strategy. While passion for a club is understandable, investment decisions should be based on financial analysis and risk assessment.

3. What are the Risks Associated with Buying Shares?

Investing in football clubs comes with significant risks:

- High Operating Costs: Football clubs face substantial expenses, including player salaries, transfer fees, and stadium maintenance. Profitability can be challenging, requiring continuous investment to stay competitive.

- On-Field Performance: A club’s share price can be heavily influenced by its performance on the pitch. Wins can boost investor confidence, while losses can trigger sell-offs. These fluctuations can be difficult to predict.

- External Factors: Events like the COVID-19 pandemic can severely impact revenue streams, leading to financial losses. For example, Manchester United reported a significant annual loss due to matchday revenue plummeting during the pandemic.

3.1 Volatility and Market Sentiment

The sports industry is subject to rapid shifts in sentiment. Player injuries, managerial changes, and unexpected results can all contribute to share price volatility.

how to buy shares in a football club

how to buy shares in a football club

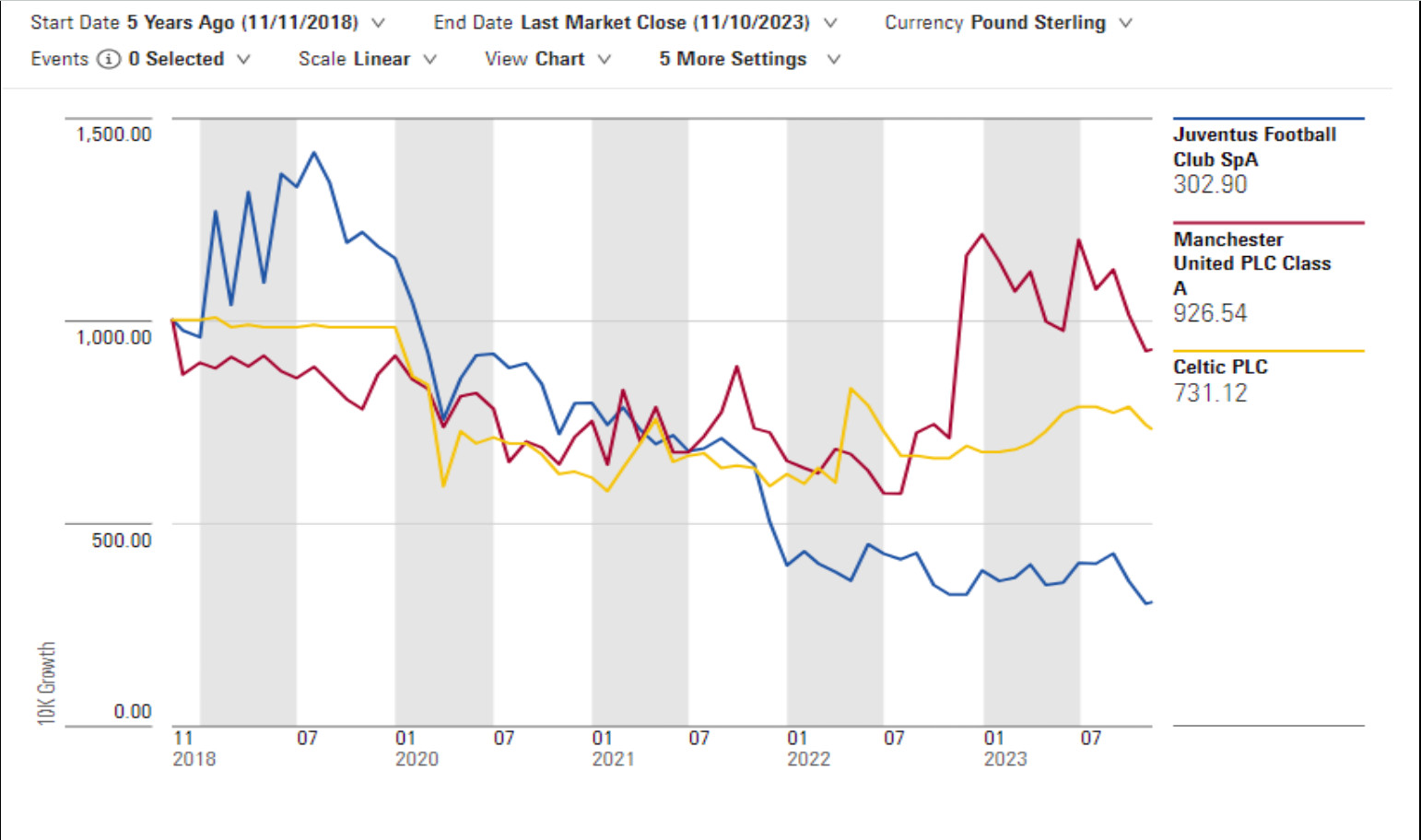

Share price performance for three well-known clubs is shown above. Past performance is not indicative of future results.

3.2 The Opinion of Experts

According to Russ Mould, investment director at AJ Bell: “Football clubs in general have proved to be terrible investments over the years.” Costs, such as salaries and transfer fees, continue to rocket and continually increase the cost of competing.

3.3 Consider Alternatives

Before investing, carefully consider your financial situation and risk tolerance. Supporting your club through season tickets or merchandise may be a more suitable option.

4. A Step-by-Step Guide: How to Buy Football Club Shares

If you decide to proceed with investing, here’s a step-by-step guide:

-

Step 1: Open an Account

- Choose a broker or online investing platform. Popular choices in the U.S. include Fidelity, Charles Schwab, and eToro.

- Consider factors like fees, investment options, and user interface.

- Decide whether to open a general investment account or a tax-advantaged account like an Individual Retirement Account (IRA).

-

Step 2: Choose Your Investment Strategy

- Lump-Sum Investing: Investing a single large sum upfront.

- Dollar-Cost Averaging: Making regular, smaller investments over time. This can mitigate risk by averaging out the purchase price.

-

Step 3: Place an Order

- Fund your account via bank transfer or debit card.

- Search for the club’s stock using its ticker symbol (e.g., MANU for Manchester United).

- Enter the number of shares you want to buy or the amount you wish to invest.

- Consider using a stop-loss order to limit potential losses.

-

Step 4: Monitor Performance

- Regularly check your investment performance (e.g., monthly, quarterly, or annually).

- Adjust your strategy based on performance and market conditions.

4.1 U.S. Brokerage Account Options

U.S. investors have access to various brokerage accounts for trading international stocks. Ensure the platform you choose allows trading on the relevant stock exchanges (e.g., NYSE, Frankfurt Stock Exchange, Milan Stock Exchange, London Stock Exchange).

4.2 Tax Implications

Consult with a tax advisor to understand the tax implications of buying and selling international stocks in the U.S., including capital gains taxes and potential foreign tax credits.

5. Exploring Alternative Investment Avenues

If you’re hesitant about buying individual club shares, consider these alternatives:

- Investment Trusts and Funds: Some investment trusts hold shares in multiple football clubs. For instance, the Finsbury Growth & Income Investment Trust has holdings in Manchester United and Juventus.

- Memorabilia: Investing in signed shirts, footballs, or collectible cards can be a passionate way to engage with your favorite club. However, be aware that the value of memorabilia can fluctuate, and liquidity may be limited.

- Sponsor Companies: Consider investing in publicly traded companies that sponsor football clubs, such as Adidas (ADDYY), which has a long-standing partnership with Manchester United.

5.1 Diversification is Key

Diversifying your investment portfolio is essential to mitigate risk. Combining different investment avenues can provide a more balanced approach.

6. Expert Advice: Proceed with Caution

Russ Mould at AJ Bell advises: “Buy the shares for emotional reasons of attachment by all means, but do so with eyes wide open.”

7. Key Considerations for U.S. Investors

- Currency Exchange Rates: Be aware of currency exchange rates when investing in clubs listed on foreign exchanges. Fluctuations in exchange rates can impact your returns.

- International Trading Fees: Check with your broker about fees associated with trading on international stock exchanges. These fees can vary.

- Regulatory Differences: Understand the regulatory differences between U.S. and foreign stock markets.

8. Case Studies: Examining Club Share Performance

Analyzing the historical performance of publicly traded football clubs provides valuable insights.

8.1 Manchester United (MANU)

While Manchester United is a global brand, its share price has experienced volatility. Factors such as on-field performance, managerial changes, and overall market conditions have influenced its stock performance.

8.2 Juventus (JUVE.MI)

Juventus shares have also seen fluctuations. Sporting success, financial performance, and broader economic trends in Italy have all played a role.

8.3 Borussia Dortmund (BVB.DE)

Borussia Dortmund’s stock performance is closely tied to its success in the Bundesliga and Champions League.

9. The Future of Football Club Investments

The landscape of football club ownership and investment is constantly evolving.

9.1 Emerging Markets

Keep an eye on emerging football markets, where new clubs may seek public listings in the future.

9.2 Regulatory Changes

Changes in regulations regarding club ownership and financial fair play could impact investment opportunities.

10. Summary: Is Buying Football Club Shares Right for You?

Investing in football clubs can be an exciting way to combine your passion for the sport with potential financial gains. However, it’s crucial to understand the risks involved and approach these investments with caution.

10.1 A Balanced Perspective

Weigh the emotional appeal against the financial realities. Consider your risk tolerance, investment goals, and financial situation before investing.

10.2 Seek Professional Advice

Consult with a financial advisor to get personalized guidance tailored to your specific needs.

FAQ: Investing in Football Clubs

Here are some frequently asked questions about buying shares in football clubs:

Q1: Can I buy shares in any football club?

No, only clubs that are publicly listed on a stock exchange can be invested in.

Q2: What are the main risks of investing in football clubs?

High operating costs, on-field performance volatility, and external factors such as pandemics.

Q3: How do I buy shares in a football club?

Open a brokerage account, choose an investment strategy, place an order, and monitor performance.

Q4: What are the alternative investment options?

Investment trusts, memorabilia, and sponsor companies.

Q5: Is it a good idea to invest in football clubs?

It can be, but proceed with caution, understand the risks, and consider your financial situation.

Q6: What is market capitalization?

A metric calculated by multiplying a company’s share price by the number of shares in circulation, indicating the club’s overall value.

Q7: What is a stop-loss order?

An order to automatically sell shares if the price falls below a certain level, limiting potential losses.

Q8: Should I invest a lump sum or use dollar-cost averaging?

Dollar-cost averaging can mitigate risk by averaging out the purchase price over time.

Q9: How often should I monitor my investment performance?

Regularly, such as monthly, quarterly, or annually.

Q10: What are the tax implications of investing in international stocks?

Consult with a tax advisor to understand capital gains taxes and potential foreign tax credits.

Investing in football clubs can be a unique way to connect with your favorite sport. However, it’s essential to approach these investments with knowledge, caution, and a clear understanding of the risks involved. CAUHOI2025.UK.COM is committed to providing you with the information you need to make informed financial decisions.

Ready to explore further? Visit CauHoi2025.UK.COM for more insights and resources on investing. Have more questions? Our team is here to help you navigate the world of sports investments with confidence. Contact us today through our website!